Redefining small-ticket finance through the ‘Precision Finance Value Chain’ (PFVC)

Dr Kutila Pinto

Founder & Chief Executive Officer | FINAP Worldwide

Abstract

Microfinance and nanofinance have long been framed as “services for the poor,” a label that has unintentionally limited their commercial evolution and diluted the dignity of those they serve. This article challenges that narrative and reframes small-ticket finance as a structural component of modern financial systems rather than an act of welfare. It introduces the Precision Finance Value Chain© (PFVC); a conceptual and operational framework that positions micro and nano finance as mainstream financial infrastructure grounded in dignity, transparency, efficiency, and fair access. The PFVC integrates digital rails, real-time credit, data-led assessment, and embeddedfinance capabilities to deliver right-sized, right-timed, and right-priced liquidity at scale. By aligning ethical finance with modern fintech architecture, PFVC transforms inclusion from charity into an investable, commercially sustainable, and socially equitable value chain. This article calls for policymakers, financial institutions, investors, and citizens to adopt a new vocabulary and operating model for small-ticket finance; one that measures dignity alongside delivery, and precision alongside profit.

Key words:

Precision Finance Value Chain (PFVC), Microfinance, Nanofinance, Financial Inclusion, Embedded Finance, Digital Financial Infrastructure, Ethical Finance, Responsible AI, SmallTicket Credit.

1. The Provocation

For decades, microfinance and nanofinance have been described as “finance for the poor.” The original purpose was noble. That was to support individuals excluded from traditional banking systems. Yet, over time, that designation evolved into a prison.

When we label something as “for the poor,” it becomes structurally impoverished; under-funded, undervalued and permanently marginalised. We built compassion, but we neglected precision.

2. The Historical Undercurrent

Microfinance, as formalised in the 1970s by pioneers such as Dr Muhammad Yunus and the Grameen Bank, demonstrated the transformative potential of modest loans. Yet the essence of microfinance existed long before. It was embedded in community lending and informal credit practices that addressed financial need, not poverty per se.

As governments and development agencies adopted the model, they reframed it as poverty finance, which attracted concessional funding, donor aid and philanthropic capital, but also distorted commercial incentives.

Once microfinance became associated with poverty, it stepped into the aid economy. Governments treated it as benevolence. NGOs became financial intermediaries lacking commercial discipline. Investors sought impact optics rather than return metrics. The result was a two-tier system: mainstream finance for the privileged, development finance for everyone else.

3. The Human Dimension: Perception and Dignity

Labels shape identity. In behavioural science, labelling theory1 suggests that repeated descriptors influence self-perception and aspiration.

A small-business owner seeking working capital is instantly identified as a micro borrower rather than an entrepreneur. The dignity of that transaction is quietly diminished.

Across South Asia and Africa, many borrowers hide their use of micro-loans to avoid stigma preferring higher-cost informal credit rather than being seen as beneficiaries. That is not inclusion; it is subtle exclusion.

True inclusion means no one feels poor when being served. Finance must evolve from aid-language to empowerment-language, and from beneficiary to participant, from poverty-alleviation to potential-realisation.

4. The Country & Policy Dimension

Many countries still carry the welfare DNA in their microfinance regimes. For example, Sri Lanka’s Microfinance Act No. 6 of 2016 created a separate, lesser-regulated category of microfinance institutions thus institutionalising the label.

Globally, the MSME finance gap stands at approximately US$5.7 trillion for formal enterprises and nearly US$8 trillion when informal firms are included (IFC/World Bank, 2025) (IFC 2025).

Policy must evolve:

• Define micro/nano finance by ticket size, tenor and purpose, not by social or income

category.

• Integrate these products into capital markets, credit bureaux, and digital payment rails.

• Replace blunt interest-rate caps with transparency and competition – evidence shows caps shrink supply and distort pricing (CGAP, 2024).

Countries like Kenya and India illustrate what integration can achieve: Kenya’s M-Shwari platform scaled millions of users (CGAP/GSMA, 2024) and India’s UPI processed over 20 billion monthly transactions in August 2025, dealing with nearly ₹24.85 lakh crore (≈US$281 billion) in value (NPCI, 2025)

Nearly every country can adopt this approach by embedding small-ticket lending into its national payment and digital settlement systems. Micro and nano finance are not a reflection of a nation’s wealth or poverty; they simply relate to the size and immediacy of the financial need. When we detach small-ticket finance from the poverty narrative and recognise it as a structural financial service, it becomes both universal and commercially relevant.

5. The Financial Foundations

Small-ticket lending is not inherently unprofitable, it becomes so when designed inefficiently.

Risk-based pricing identity:

APR2 = funding cost + expected loss + operating cost + margin.

Digital infrastructure can reduce operating cost per loan by up to 90%, enabling sustainable and fair small-ticket pricing.

China’s Ant Group MYbank demonstrates what is possible: “3-1-0” (3 minutes to apply, 1 second to approve, 0 human intervention) shows how inclusion and profitability can coexist (Ant Group, 2024).

When transaction cost falls, inclusion ceases to be charity and becomes sound business.

6. The Precision Finance Value Chain (PFVC): A New Way of Doing Business

This article introduces the concept of the Precision Finance Value Chain (PFVC) which is a framework born from the author’s post-DBA industry analysis and FINAP’s3 applied experiments (CIXOR PayDay, FirstMicro) as living proof of the model in motion.

Definition:

The Precision Finance Value Chain (PFVC) is a conceptual and operational framework that redefines how small-ticket finance is structured, delivered and governed. It positions micro and nano finance within the mainstream financial ecosystem. It integrates lenders, borrowers, investors and regulators into a unified, data-driven, dignity-centred value chain.

How PFVC works and what it achieves:

PFVC is digitally-enabled, dignity-centred operating model that delivers right-sized, right-timed, right-priced small-ticket finance by connecting every node in the system. This encapsulates access, assessment, distribution, engagement and regulation, into a single transparent value chain.

The PFVC reframes micro and nano finance as mainstream financial infrastructure. It humanises digital delivery, lowers unit cost and creates continuous data-flows so lenders, borrowers, investors and regulators can each add and extract value efficiently and fairly.

Who it serves: Individuals and enterprises with small-ticket liquidity needs, regardless of income class.

Five nodes: Access & Onboarding → Assessment → Distribution → Engagement → Regulation.

Design principles: Dignity, transparency, fair access, efficiency.

Outcomes: Lower cost-to-serve, higher participation, stronger risk signals, investable portfolios, easier oversight.

Currently, mainstream banks often overlook small-ticket borrowers because mobilisation cost, assessment cost and distribution cost outweigh return-on-investment. As a result, microentrepreneurs turn to micro/nano lenders or informal sources.

By addressing each stage of the chain:

1. Access & Onboarding: humanised digital systems reduce entry friction.

2. Assessment: data-led behavioural scoring replaces manual credit policy.

3. Distribution: automated disbursement and repayment reduce cost per loan.

4. Engagement: continuous digital connectivity builds trust and retention.

5. Regulation: real-time data enables proactive supervision and adaptive policy

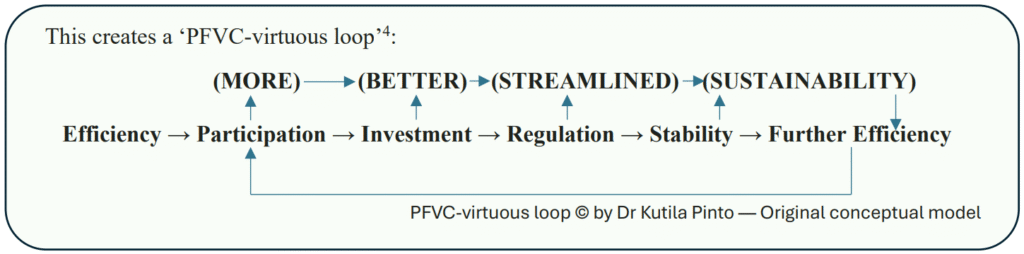

The Precision Finance Value Chain (PFVC)-virtuous loop is a systems-based conceptual model that explains the self-reinforcing dynamics required to achieve sustainable, commercially viable, and dignity-centred small-ticket finance within modern financial ecosystems. The model is grounded in value-chain theory, behavioural finance, and financial inclusion literature, and illustrates how improvements at one stage of the PFVC create compounding benefits across the entire system.

The loop initiates with Efficiency, achieved through digital enablement, process optimisation, and low-friction access to micro and nano financial services. Increased efficiency reduces the cost-toserve, enhances user experience, and lowers barriers to entry, which collectively stimulate Participation among underserved individuals and micro-enterprises. As participation expands, transaction volumes, repayment data, and user insights increase, thereby strengthening the information base and commercial attractiveness of the ecosystem.

Higher participation levels act as a catalyst for Investment, drawing interest from financial institutions, impact investors, technology providers, and development finance actors. The infusion of financial and technological capital enables innovation, scale, and product diversification across the PFVC. As investment deepens, Regulation evolves in parallel, supported by enhanced data transparency, supervisory visibility, and conduct-focused oversight frameworks. This results in a more Stable financial environment characterised by improved portfolio quality, reduced risk of consumer harm, and stronger institutional trust.

Stability, in turn, reinforces and strengthens the conditions for Further Efficiency, as mature systems enable continued process improvement, lower operating costs, and broader policy alignment. This generates an upward, self-sustaining cycle of value creation, where efficiency drives participation, participation drives investment, investment enables effective regulation, and regulation preserves stability which loops back to accelerate further efficiency. Over time, this dynamic produces a scalable, transparent, and socially equitable financial infrastructure capable of delivering:

• greater inclusion (MORE) in terms of reach, coverage, and participation,

• improved quality (BETTER) of financial services and consumer outcomes,

• enhanced alignment (STREAMLINED) across policy, technology, and market actors, and

• long-term viability (SUSTAINABILITY) for both providers and users.

The PFVC-virtuous loop therefore reframes micro and nano finance from a welfare-centred intervention to an integrated, investable, and resilient financial system function. It positions smallticket finance not as an exception to mainstream finance, but as a structural component of a modern digital economy, capable of delivering both commercial returns and socio-economic value at scale.

Responsible Data and AI Use within the PFVC

As small-ticket finance evolves into real-time and data-driven ecosystems, the responsible use of customer data and digital scoring becomes essential (European Commission 2025). The PFVC framework recognises that data must be used with consent, clarity, and care. While advanced analytics and AI can enhance precision in assessing financial behaviour, they must never undermine dignity or fairness. Algorithms must be interpretable, non-discriminatory, and subject to human oversight, ensuring that technology does not replicate bias or exclude vulnerable groups. Data privacy, purpose limitation, and secure handling are not technical features, but ethical commitments. Within the PFVC, responsible AI and data governance form a core expectation that protects citizens while enabling innovation.

Precision without ethics becomes exploitation; PFVC demands that intelligence irrespective of human or artificial respects dignity.

7. The Ethical Framework of PFVC

The PFVC stands on four ethical pillars:

1. Dignity: Every client is a participant, not a beneficiary.

2. Transparency: All terms and costs are disclosed clearly.

3. Fair Access: Service quality must never be determined by ticket size or geography.

4. Efficiency: Technology must reduce cost without diminishing respect.

These principles align with:

• SDG 8 (Decent Work & Economic Growth)

• SDG 9 (Industry, Innovation & Infrastructure)

• SDG 10 (Reduced Inequalities) and

• SDG 17 (Partnerships for the Goals)

8. PFVC in the Age of Embedded Finance

The global financial system is shifting towards embedded finance and real-time credit ecosystems, where financial services are delivered seamlessly within everyday customer journeys rather than through traditional banking channels (BIS FSI 2024). As payment systems evolve to instant and data-rich infrastructures, small-ticket credit can be offered precisely at the moment of need. Which must be inside commerce, employment, community platforms, and digital services.

The PFVC provides the operating architecture for this shift. It defines the nodes, the data flows, and the accountability required to deliver small-ticket credit with speed, accuracy, and dignity. By aligning onboarding, assessment, disbursement, engagement, and regulation to real-time digital rails, PFVC enables a low-cost, API-driven credit ecosystem that supports embedded delivery without compromising transparency or conduct standards.

How PFVC enables embedded finance:

• Real-time decisioning: Data-led and consent-based risk assessment at the point of

need.

• Instant settlement: Disbursement and repayment through national fast-payment

rails.

• API-based governance: Standardised telemetry for regulators, replacing blunt controls with data-driven oversight.

PFVC positions micro and nano credit not as a development tool, but as core digital financial infrastructure for modern economies.

9. The Call to Action

To Policymakers:

• Remove welfare classifications from financial legislation.

• Embed micro/nano definitions into prudential frameworks and data systems.

• Mandate APR disclosure and open-API interoperability.

To Financial Institutions & FinTech:

• Price for risk, not status.

• Automate for efficiency; design for dignity.

• Measure service quality by experience, not by subsidy.

To Investors:

• Measure efficiency as impact.

• Invest in scalable, transparent PFVC-based platforms where commercial return meets social value.

To Citizens:

• Demand fairness, not favour.

• Whether you borrow 500 or 5 million, expect clarity, speed and respect.

10. The Vision Forward

Countries that integrate small-ticket finance into mainstream systems will unlock a new productivity class. This will add millions of individuals and enterprises operating with formal credit histories, digital liquidity and confidence.

The PFVC is not a subset of banking; it is the connective-tissue of modern finance. It restores transparency to the largest transactions and dignity to the smallest.

FinTechs and financial providers operating-with-regulatory-approval can lead this change, evolving the PFVC framework in real-world innovation, by productisation and partnerships across markets.

11. Concluding Reflection

Micro and Nano Finance were never about scarcity and they were about precision. When we stop financing people by their labels and start serving them by their needs, inclusion becomes inevitable, dignity becomes measurable and growth becomes shared.

12. Bibliography

• Bank for International Settlements – Financial Stability Institute (2024) A Two-Sided Affair: Banks and Tech Firms in Banking (FSI Insights No. 60). Available at: https://www.bis.org/fsi/publ/insights60.htm

• CGAP (2024) Interest Rate Ceilings and their Effects on Microfinance Markets. Available at: https://www.cgap.org/sites/default/files/CGAP-Donor-Brief-The-Impact-of-Interest-RateCeilings-on-Microfinance-May-2004.pdf

• CIXOR (2025) is rapidly becoming the gold standard for fair, instant, and intelligent access to wages. Available at: https://cixor.lk/about-us/

• European Commission (2025) The EU Artificial Intelligence Act: Rules for Trustworthy and Human-Centric AI. Available at: https://digital-strategy.ec.europa.eu/en/policies/eu-ai-act

• FINAP (2025) It offers a low-cost monthly subscription model and features tailored to meet the unique needs of nanofinance service providers. Available at:

https://finapworldwide.com/products/firstmicro-microfinance-platform/

• IFC (2025) MSME Finance Gap Factsheet. Available at: https://www.ifc.org/en/what-wedo/sector-expertise/financial-institutions/msme-finance

• NPCI (2025) UPI Ecosystem Statistics – Aug 2025. Available at: https://www.npci.org.in/what-we-do/upi/upi-ecosystem-statistics

• World Bank (2025) MSME Finance Gap: Assessment of the Shortfalls and Opportunities. Available at: https://documents.worldbank.org/en/publication/documentsreports/documentdetail/653831510568517947/msme-finance-gap-assessment-of-theshortfalls-and-opportunities-in-financing-micro-small-and-medium-enterprises-in-emergingmarkets

• GSMA (2024) Tiered Risk-based KYC: M-Shwari Successful Customer Due Diligence. Available at: https://www.gsma.com/solutions-and-impact/connectivity-for-good/mobilefor-development/country/kenya/tiered-risk-based-kyc-m-shwari-successful-customer-duediligence/

• SME Finance Forum (2025) Global SME Finance Forum Event Overview. Available at:

https://www.globalsmefinanceforum.com/

• McKinsey Global Institute & World Bank (2016): Digital Finance for All: Powering

Inclusive Growth in Emerging Economies (evidence of 80–90 % cost reduction). Available at: https://www.mckinsey.com/featured-insights/employment-and-growth/how-digitalfinance-could-boost-growth-in-emerging-economies

• World Bank (2022): Digital Identification and e-KYC in Financial Inclusion: India Case

Study (cost of KYC reduced from US$12 → US$0.06). Available at: https://documents.worldbank.org/en/publication/documentsreports/documentdetail/099155303222236661/p1750790c68c770d50900020f1f5e9b030b

• Centre for Global Development (2019): Digital ID, Financial Inclusion and Trust (KYC cost reduction of 97 %). Available at: https://www.cgdev.org/publication/digital-id-financialinclusion-and-trust

• Arab Monetary Fund (2023): Policy Guide: Digital Financial Services and Financial

Inclusion (digital-onboarding cost cuts up to 90 %). Available at: https://www.amf.org.ae/en/publications/2023/digital-financial-services-and-financialinclusion-policy-guide

• Ant Group (2024): Leveraging AI, MYbank enables financing services for 53 million SMEs. Press release, 30 April. Available at: https://www.antgroup.com/en/news-media/pressreleases/1714473000000

Precision Finance Value Chain (PFVC), Microfinance, Nanofinance, Financial Inclusion, Dignity in Finance, Small-Ticket Credit, Embedded Finance, Real-Time Credit Ecosystems, Digital Financial Infrastructure, Financial Regulation, Inclusive FinTech, Digital Identity and e-KYC, MSME Finance Gap, Behavioural Finance & Labelling Theory, Ethical Finance, FinTech for Development, Open Finance & API-based Systems, Financial System Reform, Cost-to-Serve Economics, Value Chain Transformation, Responsible data and AI use