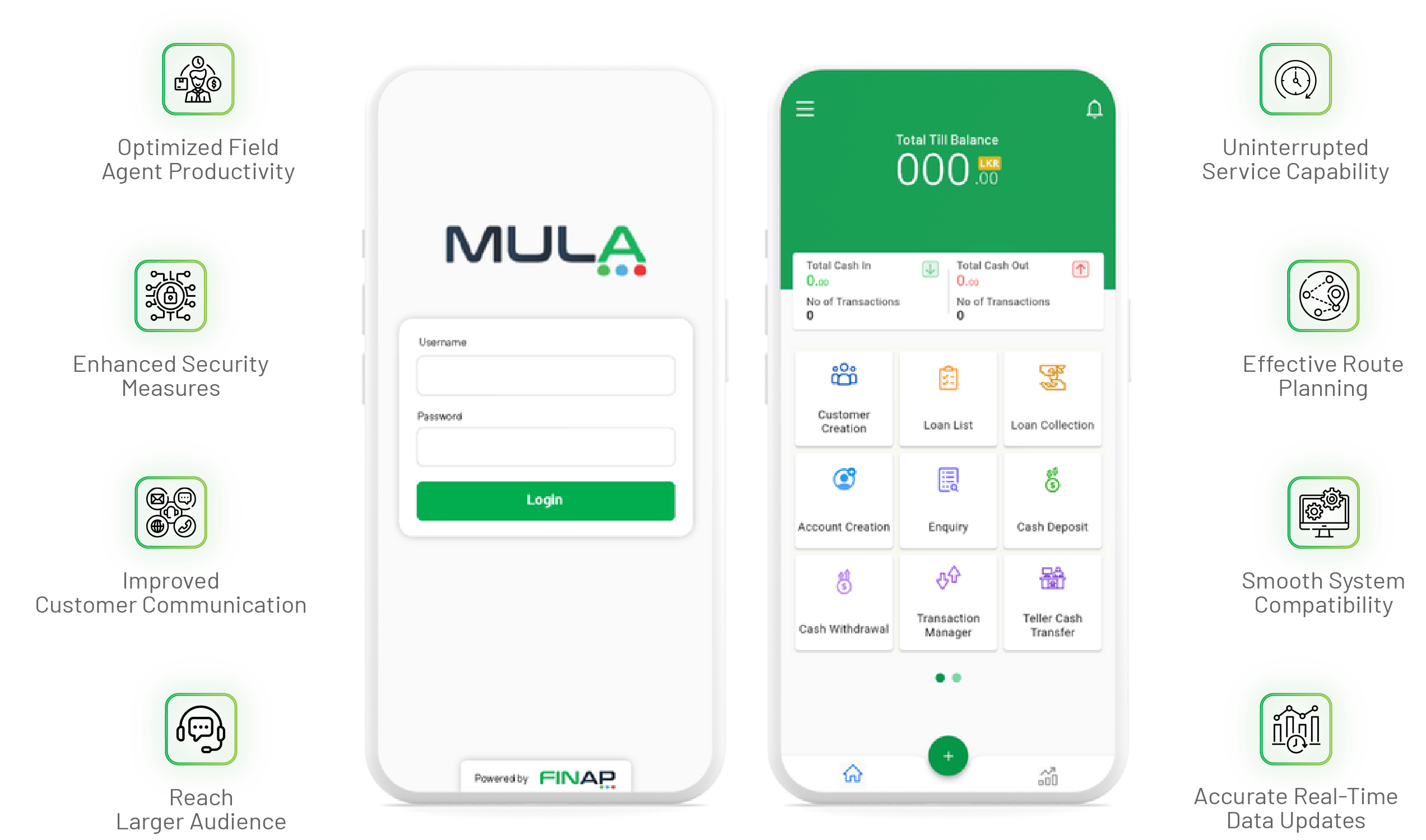

MULA - Field Agent Mobile Application

Reach in to reach out!

MULA Field Agent Mobile app digitalizes the core processes carried out by field agents of microfinance, finance & banking while improving their efficiency and reducing operational costs. It is embedded with real-time transactions, high-security controls & offline mode, which enables field agents to work in remote areas with little or no internet connectivity. Therefore, eliminating the need for a customer to physically visit a central branch.

The application digitalizes the daily tasks of field agents, and it can integrate easily with cloud-native core banking systems. MULA works on iOS and Android devices alike. The MULA Digital Field Agent app can easily streamline loan processing and other back-office banking processes. MULA can enhance efficiency and remarkably reduce operational costs.

There is a vast untapped market of the unbanked population in the developing world, which traditional banking channels have failed to reach. MULA helps FSPs to overcome geographical barriers to reach the financially underserved. A network of strategically positioned agents powered by MULA can facilitate branchless expansion.

The story behind MULA

Historically MFIs were facing challenges to bring much-needed financial services to rural populations around the globe. Despite these obstacles, MFIs have been offering quality, affordable, and convenient financial services to the financially underserved. However, due to the limitations in scalability, costs, and other issues, there is a significant proportion of the global population that are financially excluded. Traditional brick-and-mortar banking channels cannot always afford to serve the poorest rural population. Even with the use of field agents, the bank’s reach is limited.

That is where MULA comes in…

A Digital Field Agent (DFA) app like no other.

What can MULA do?

MULA is embedded with special functions and features that cannot be found in a typical field agent application. An agent can use MULA to onboard customers, create loans, upload relevant documents, and disburse loans, all away from the bank’s branch. MULA automates the entire loan process paving the way for a paperless bank.

The application facilitates real-time transactions and high-security controls. The built-in route setup function enables field agents to easily navigate their routes, and it enables managers to assign routes with ease.

“MULA brings banking to the customer’s doorstep…”

List of industries MULA can be repurposed for :

Book a Live Demo With Us

Partner with us for a state of the art mobile application.

FINAP has delivered cutting-edge Fintech solutions for financial service providers for many years. We also pride ourselves on providing exceptional customer service 24/7/365. Be a part of our happy clientele.

Give us a call or send an email now to book a demo with us today!

Customer Support

Technical FAQ

Business FAQ

MULA is specifically tailored for microfinance, finance, and banking institutions seeking to improve financial inclusion, streamline processes, and reduce paperwork. It is suitable for institutions of all sizes looking to enhance their field operations.

MULA automates the entire loan process, from customer onboarding to loan disbursal, away from the central branch, paving the way for a paperless banking experience. It offers features such as real-time general ledger updates, route setup and navigation, end-of-day proofing, and instant customer onboarding.

Yes, MULA is equipped with offline functionality, allowing field agents to work in remote areas with no internet access. This feature ensures that transactions can be conducted seamlessly even in areas with limited connectivity, eliminating the need for customers to physically visit a central branch.

MULA incorporates high-security controls, such as user transaction limits, real-time general ledger updates, and voice recording functionality, to ensure the security and integrity of transactions. Additionally, it offers core banking integration and SMS alerts to provide real-time updates and enhance transparency for both agents and customer

What is ECOru ?

FINAP Software Products

- ECOru - The Banking Software

- FirstMicro – The Microfinance Software

- Cixor - The Nanofinance Solution

- MULA - Field Agent Mobile Application

- OCEANUS – Neo Banking & Wallet Solution

- OMS – Retail Order Management & Forecasting Solution

- WMS Plus – Warehouse Management System

- LMD – Ultimate Last-Mile Delivery Solution

- FLEX - “Uber” For Logistics Solutions

- AR Tracker – Accounts Receivable