Fintech Friday

- Home

- Fintech Friday

# Fintech Friday

Fintech Friday Post 01 - Fintech Industry

The scope of Fintech extends across multiple industry verticals making financial services affordable & accessible to everyone. #FINAP, a leading Fintech solutions provider in the Asia Pacific region, offers an extensive range of software products & services to a diverse clientele.

#FintechFriday #Fintech #FINAP

The scope of Fintech extends across multiple industry verticals making financial services affordable & accessible to everyone. #FINAP, a leading Fintech solutions provider in the Asia Pacific region, offers an extensive range of software products & services to a diverse clientele.

#FintechFriday #Fintech #FINAP

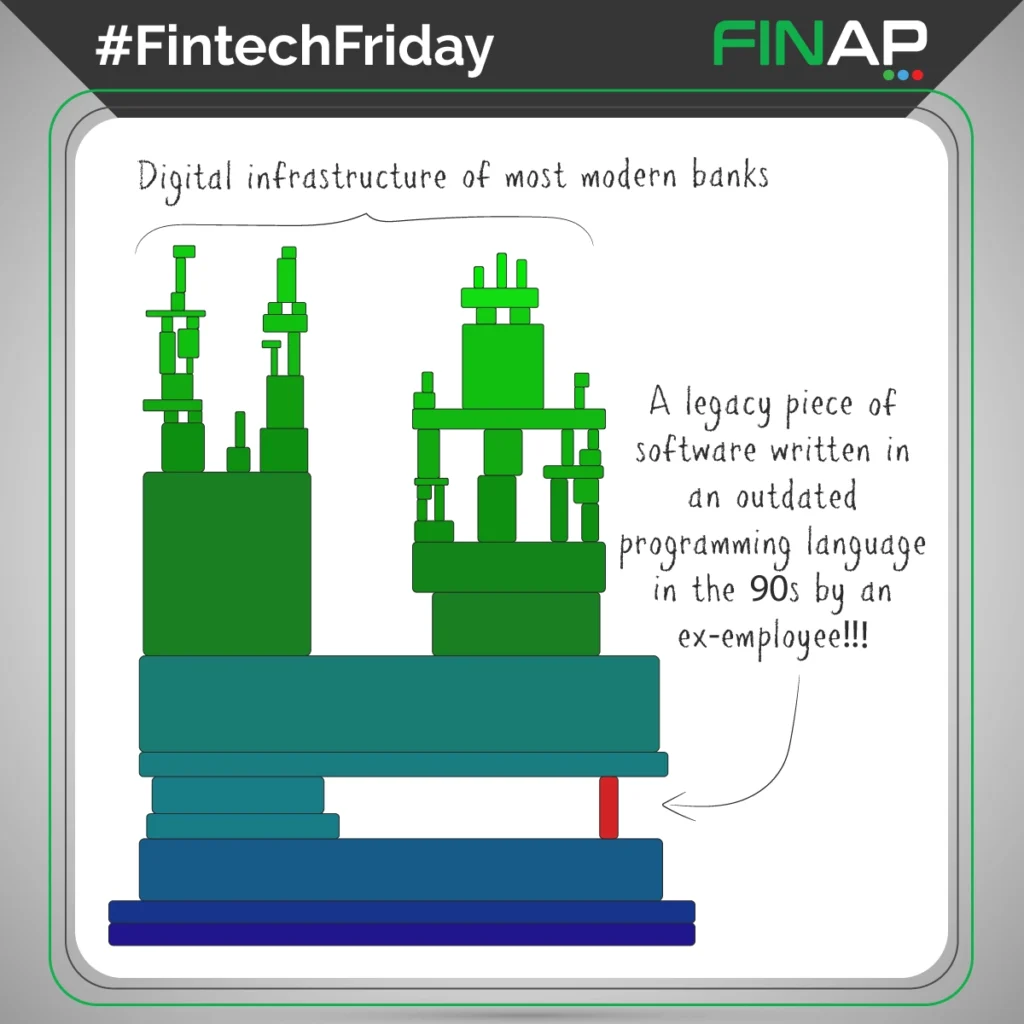

Fintech Friday Post 02 - Legacy Banking Issues

Do you know that many financial service providers’ core IT infrastructures are resting upon fragile, outdated technology?

Digitalized services & frontends are often built on top of #legacy software. System failures, downtimes, and data breaches have become commonplace in the industry. It is time for a well overdue upgrade and we are all about providing simple fintech solutions for such complex problems.

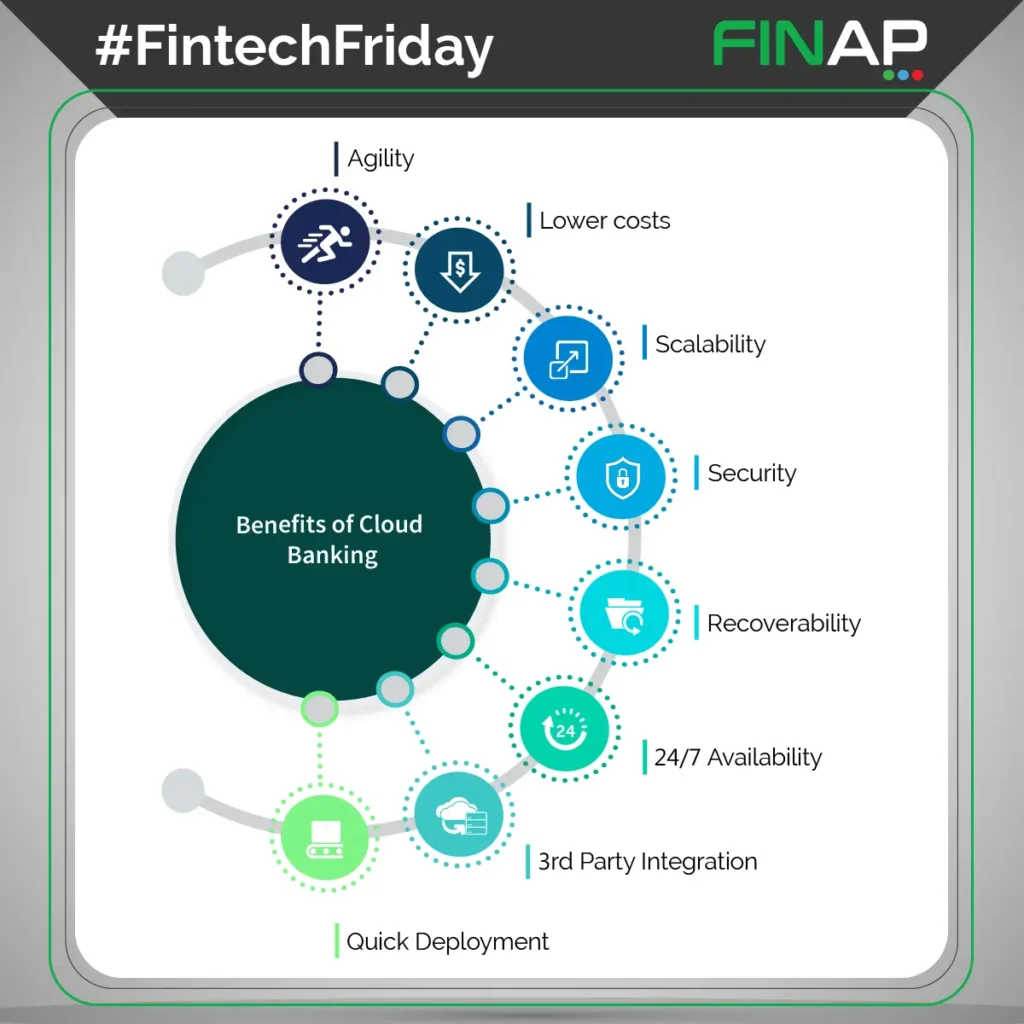

Fintech Friday Post 03 - Cloud Banking Benefits

Cloud computing offers an abundance of features & benefits to Financial Service Providers in contrast to traditional on-premises approach. Surprisingly, many FSPs are still hesitant in adopting cloud banking due to misconceptions and fallacies.

#FintechFriday #Fintech #FINAP

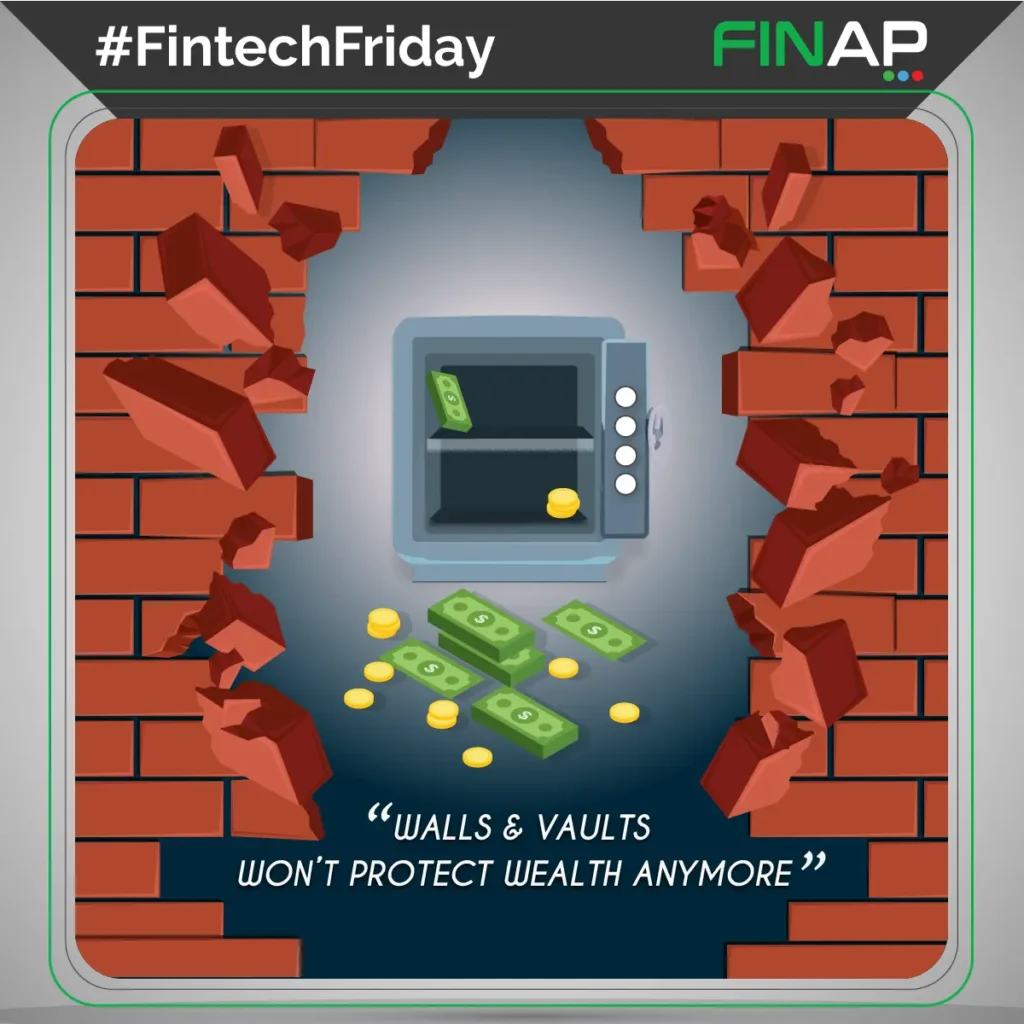

Fintech Friday Post 04 - Data Protection & Cyber Security

For centuries banks have been protecting our wealth under lock & key. But now, new and more dangerous threats are looming over the industry.

A vault can secure physical assets, but what about data?

Even a single breach of PII (Personally Identifiable Information) could have far-reaching ramifications.

Data protection and cyber security are of utmost importance to modern day banking. An advanced cloud-native core banking solution would be a good place to start!

#FintechFriday #Fintech #FINAP

Fintech Friday Post 05 - Andy Hertzfeld (Cloud Technology)

Although cloud technology has come a long way since 1994, Andy Hertzfeld’s (Member of the original Apple Macintosh development team) quote still holds up today. Mobility, scalability, recoverability, data security, and cost savings are just a few benefits of going to the cloud. Remote working in the middle of the pandemic would never be possible if not for cloud technology.

#FintechFriday #Fintech #FINAP

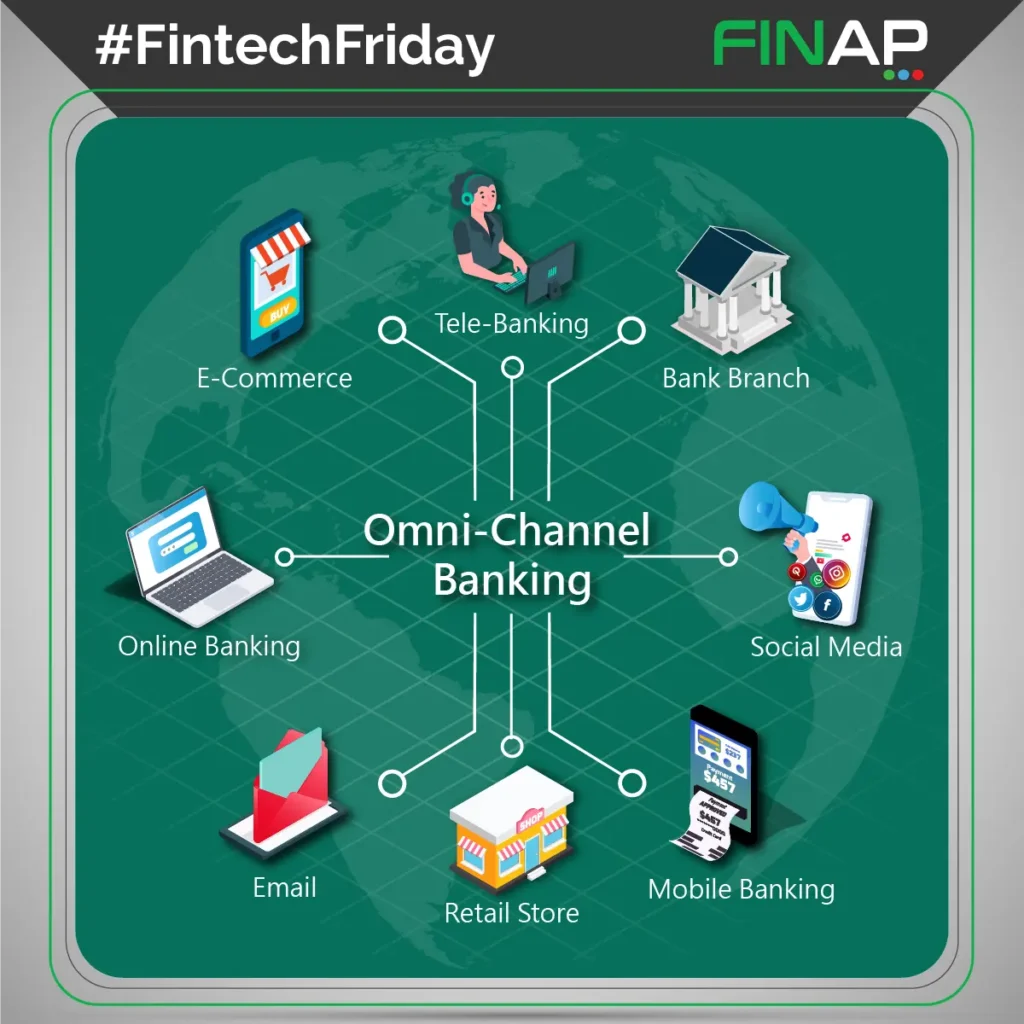

Fintech Friday Post 06 - Omni Channel Banking

Omni-Channel Banking provides the same financial products & services for customers across multiple channels, both online & offline, regardless of geographical location or time of day. Cloud technology, big data, artificial intelligence & real-time synchronization enable users to begin a process via one channel and resume it on another without having to set up again.

#FintechFriday #Fintech #FINAP

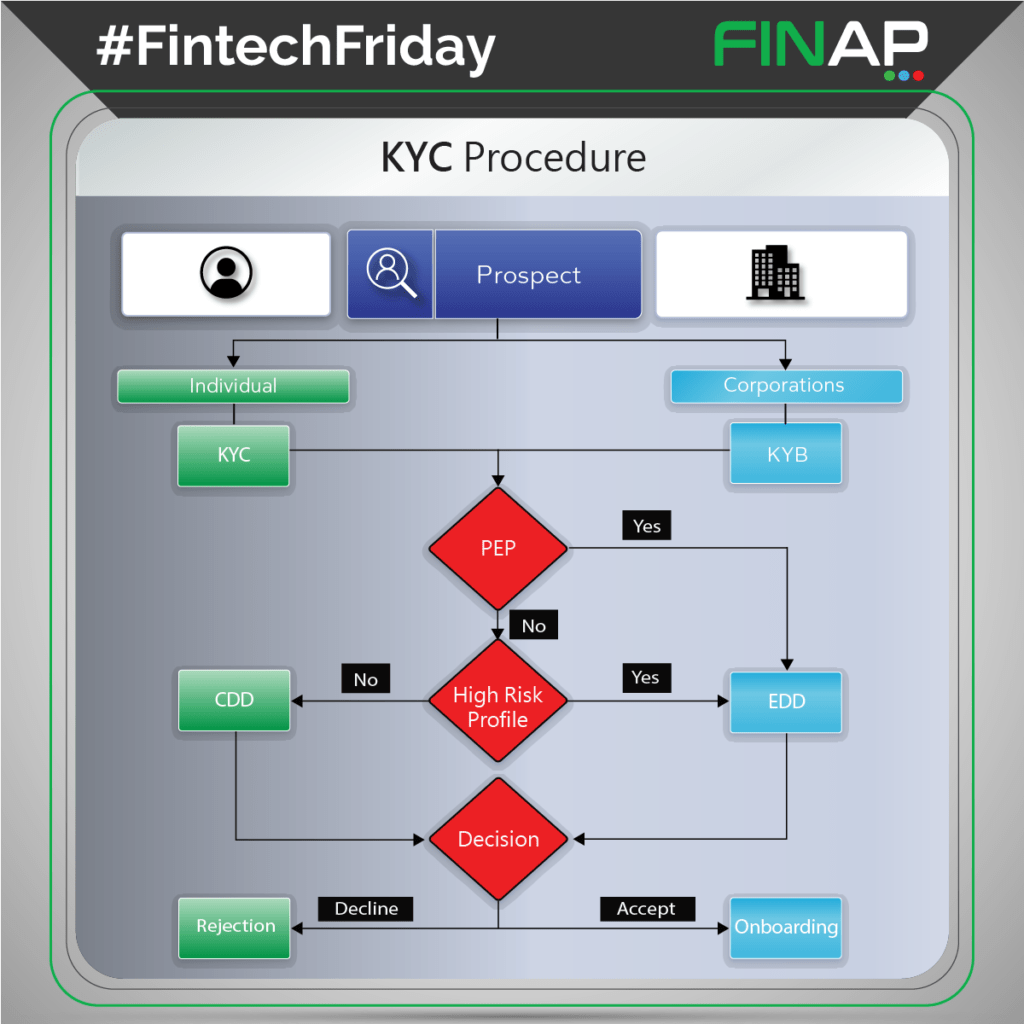

Fintech Friday Post 07 - KYC Process Flowchart

The KYC (Know Your Customer) process takes place before the onboarding of a new client to a financial institution.

The first step is to identify if the customer is a PEP (Politically Exposed Person). If it is a corporate profile, the Ultimate Beneficial Owner (UBO) must be considered for verification. A Customer Due Diligence (CDD) or an Enhanced Due Diligence (EDD) should be carried out according to the risk rating of the profile. Based on the criteria provided, the decision will be automatically generated by the system. Financial institutions have the right to refuse services for any client or business entity that falls short of the minimum KYC requirements. KYC process prevents terrorist financing, money laundering, misuse of public funds, identity theft, and other financial crimes.

#FintechFriday #Fintech #FINAP

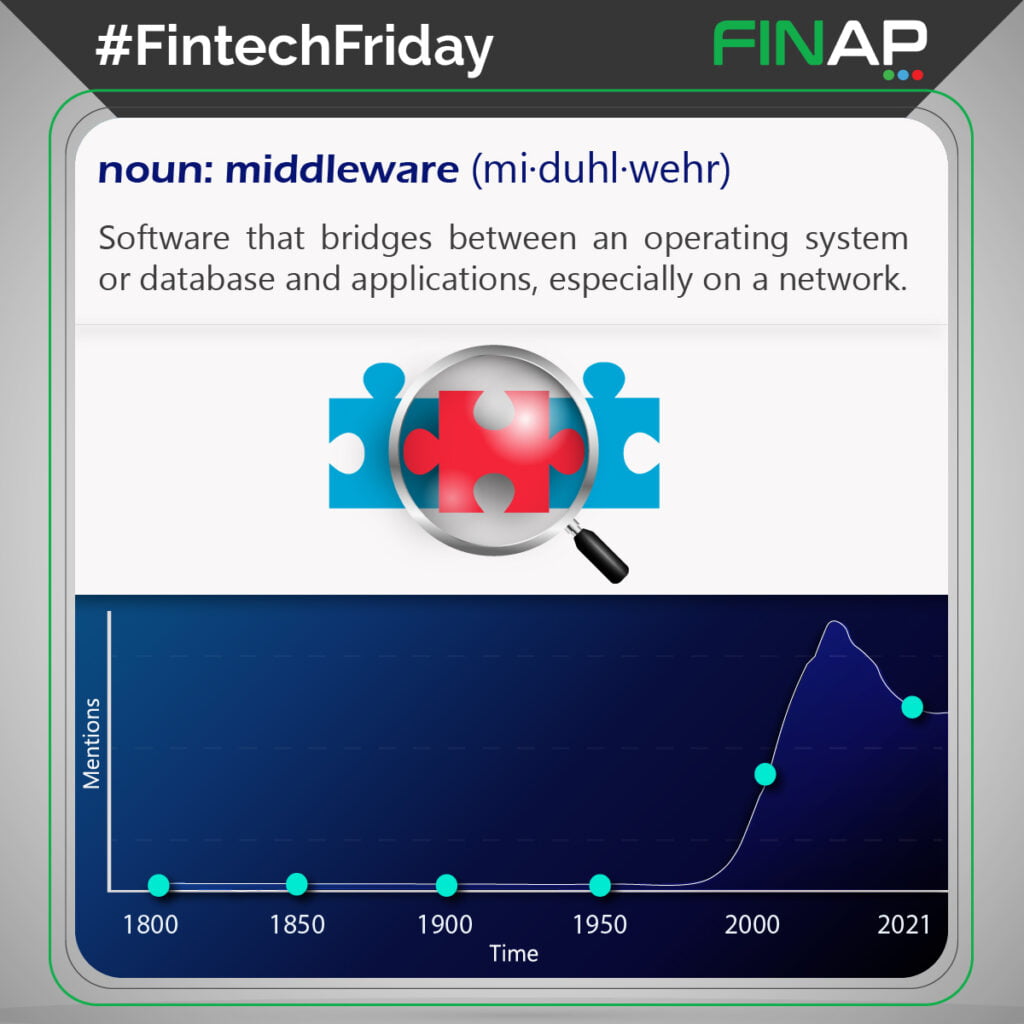

Fintech Friday Post 08 - Word Definitions - Middleware

Middleware was named as such due to its typical function as an intermediary between an operating system and its user. Middleware plays a central role in cloud computing and API-driven platforms. Middleware can also link older legacy software with newer versions that do not work well with each other.

#FintechFriday #Fintech #FINAP

Fintech Friday Post 09 - Bill Gates (Digital Banking)

One of the most pressing issues of many developing nations is not having access to cheap and convenient financial services. Conventional banking approaches have been unable to make a positive impact in emerging economies. Traditional brick-and-mortar banking channels cannot always afford to serve the poorest rural population. Gates envisions a future where most of the developing world will have access to finance through mobile banking and other fintech innovations.

#FintechFriday #Fintech #FINAP

Fintech Friday Post 10 – The global financial system depends on MS Excel

Many financial institutions still depend on Microsoft Excel for at least some of their operations. MS Excel is one of the best spreadsheet software available today. However, Excel does come with its limitations. Spreadsheet software such as MS Excel has been a substitute for core banking systems, databases, and ERP solutions for too long although, it cannot deliver the same quality of functionality required. In comparison to custom-made business solutions, spreadsheets are highly vulnerable to human errors, manipulation, and security breaches.

#FintechFriday #Fintech #FINAP

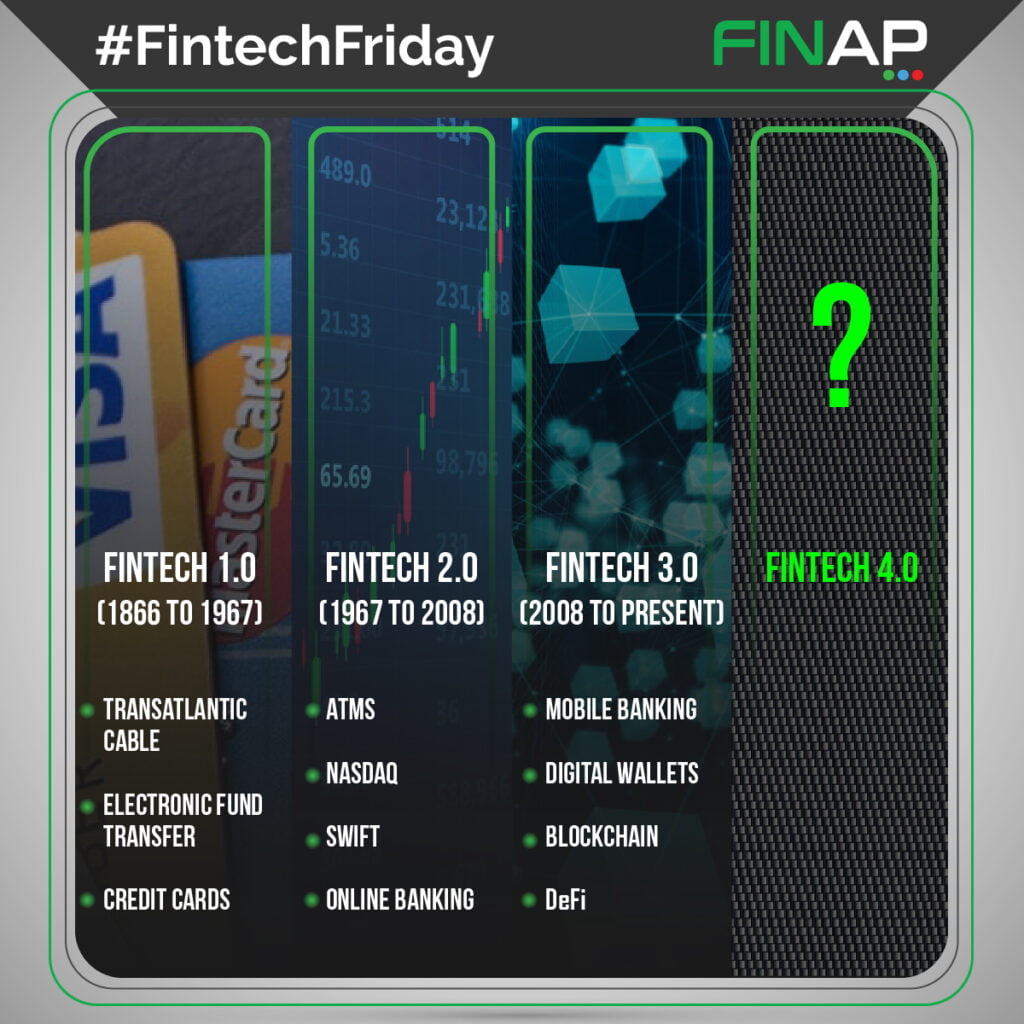

Fintech Friday Post 11 - Evolution of Fintech

The #transatlantic cable connecting Europe and America in 1866 marked the beginning of the first fintech era. Electronic fund transfers and credit cards were notable innovations of this period. In 1967 Barclays invented the first #ATM Machine, which brought along a period of global financial digitization. In 2008, the Bitcoin whitepaper introduced #blockchain technology to the world, marking the beginning of the fintech 3.0 era. Fintech innovations have made financial services accessible and affordable than ever before. #DeFi (Decentralized Finance) will be the revolutionary force of fintech 3.0 which is evolving at a breathtaking pace. Now the real question is, what would fintech 4.0 look like?

#FintechFriday #Fintech #FINAP

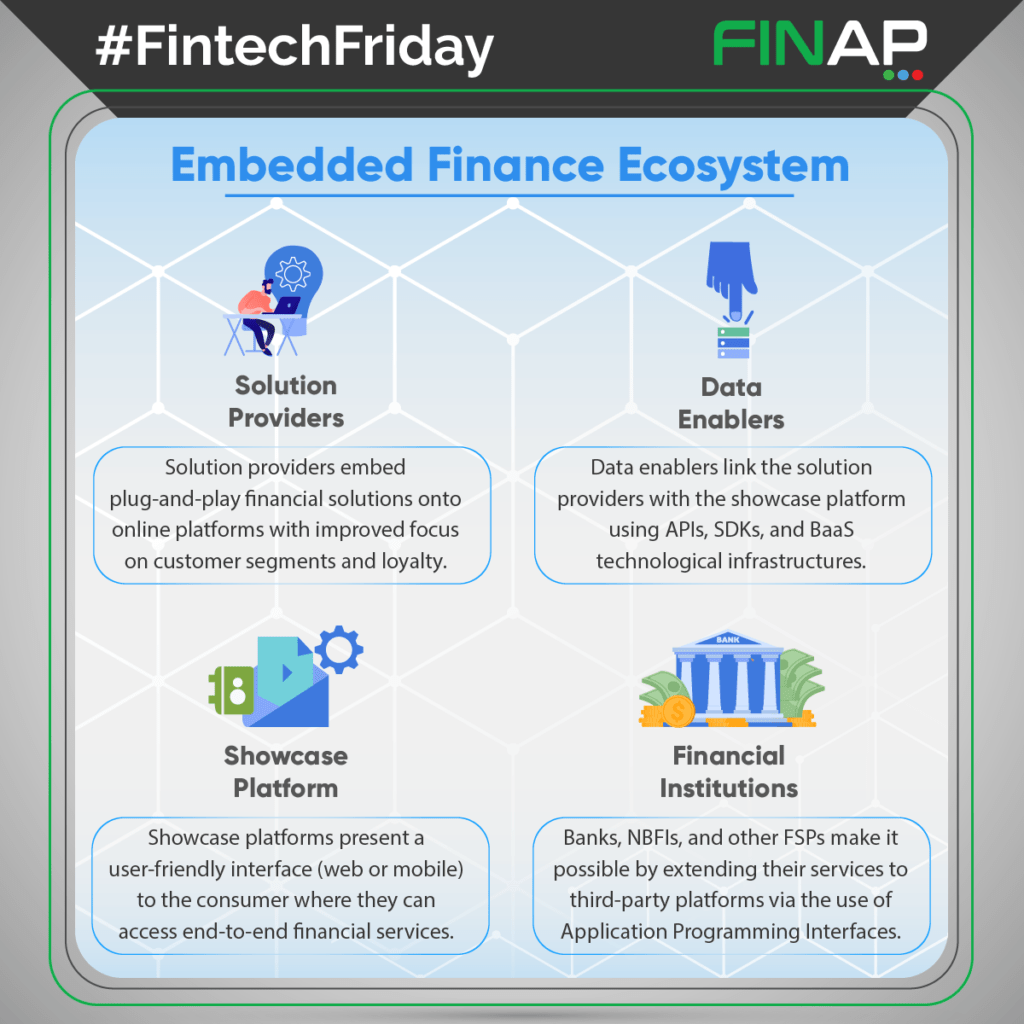

Fintech Friday Post 12 - Embedded Finance

Solution providers, data enablers, showcase platforms, and financial institutions are the essential players of the embedded finance ecosystem.

Banks, NBFIs, and other Financial Service Providers (FSPs) make it all possible by extending their services (#BaaS) to third-party platforms such as fintech firms, tech giants, and e-commerce sites.

Embedded finance opens up new streams of revenue for financial institutions while considerably enhancing the consumer experience.

#FintechFriday #Fintech #FINAP

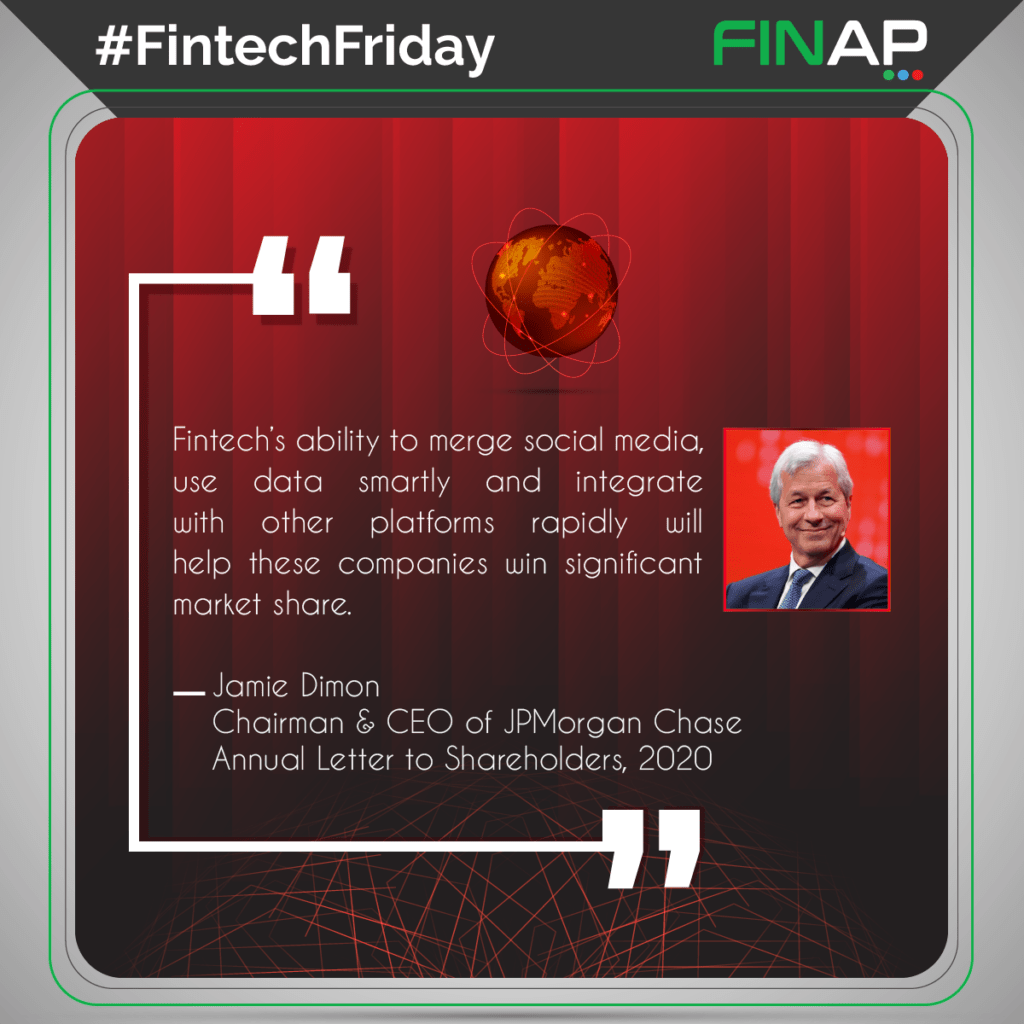

Fintech Friday Post 13 Jamie Dimon (JPMorgan Chase)

Fintech products interact and integrate well across multiple platforms. It is phenomenal how fintech products and services are pushing the boundaries of the financial services industry. Fintech companies can serve consumers in many ways that traditional banks could not. According to the highly distinguished banker Jamie Dimon, bureaucracy, complacency, and unwillingness to adopt modern technological solutions are holding back the traditional banking industry. Dimon was particularly critical about the inflexible “legacy systems” that need to be moved to the cloud if they are to remain competitive.

#FintechFriday #Fintech #FINAP

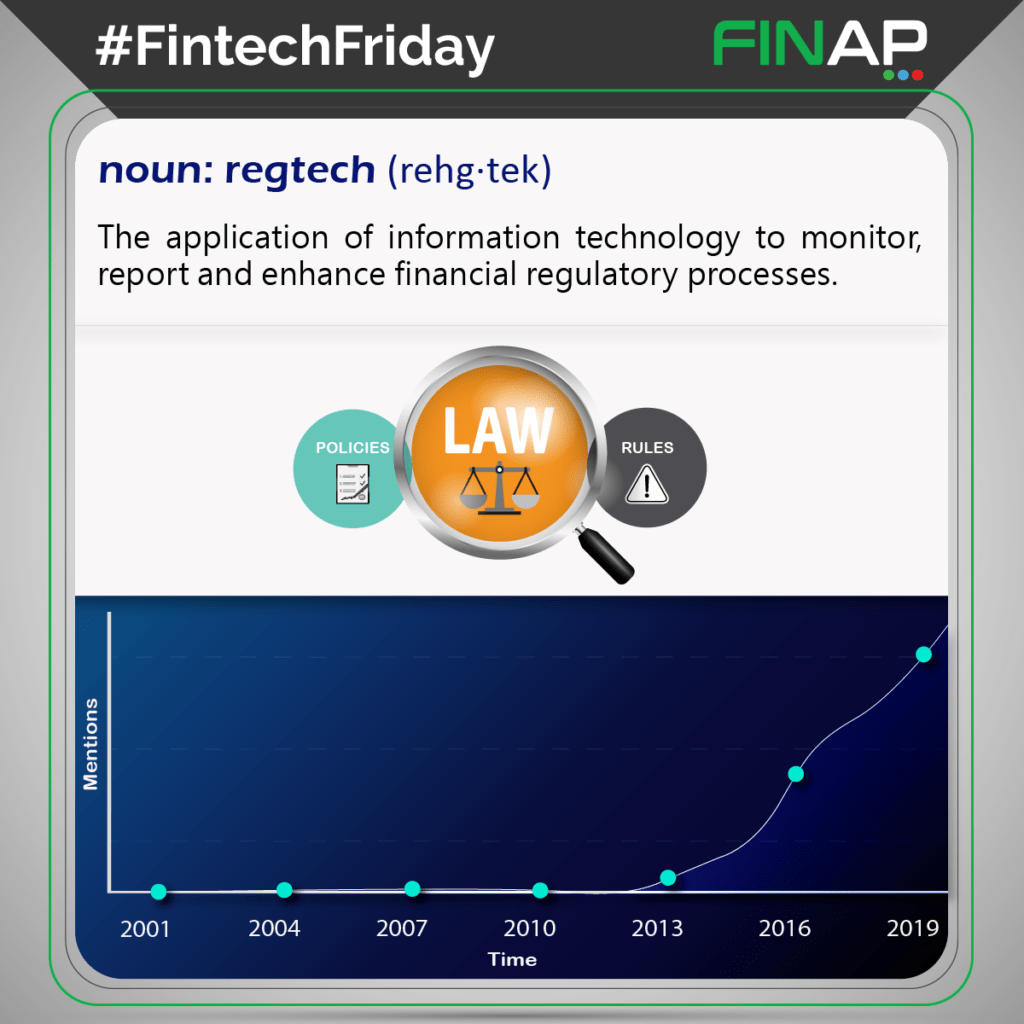

Fintech Friday Post 14 Word definition – Word Definitions - RegTech

RegTech is a subset of technology that falls under the umbrella of fintech. Much like fintech, the word RegTech is a fusion of two words, namely Regulatory and Technology. The RegTech sector has witnessed significant growth since the financial crisis in 2008.

#RegTech solutions providers strive to prevent financial crimes such as money laundering, terrorist financing, bribery, corruption, market manipulation, tax evasion, and fraud. RegTech service providers collaborate with financial institutions and regulatory authorities to uphold the transparency & integrity of the global financial industry.

#FintechFriday #Fintech #FINAP

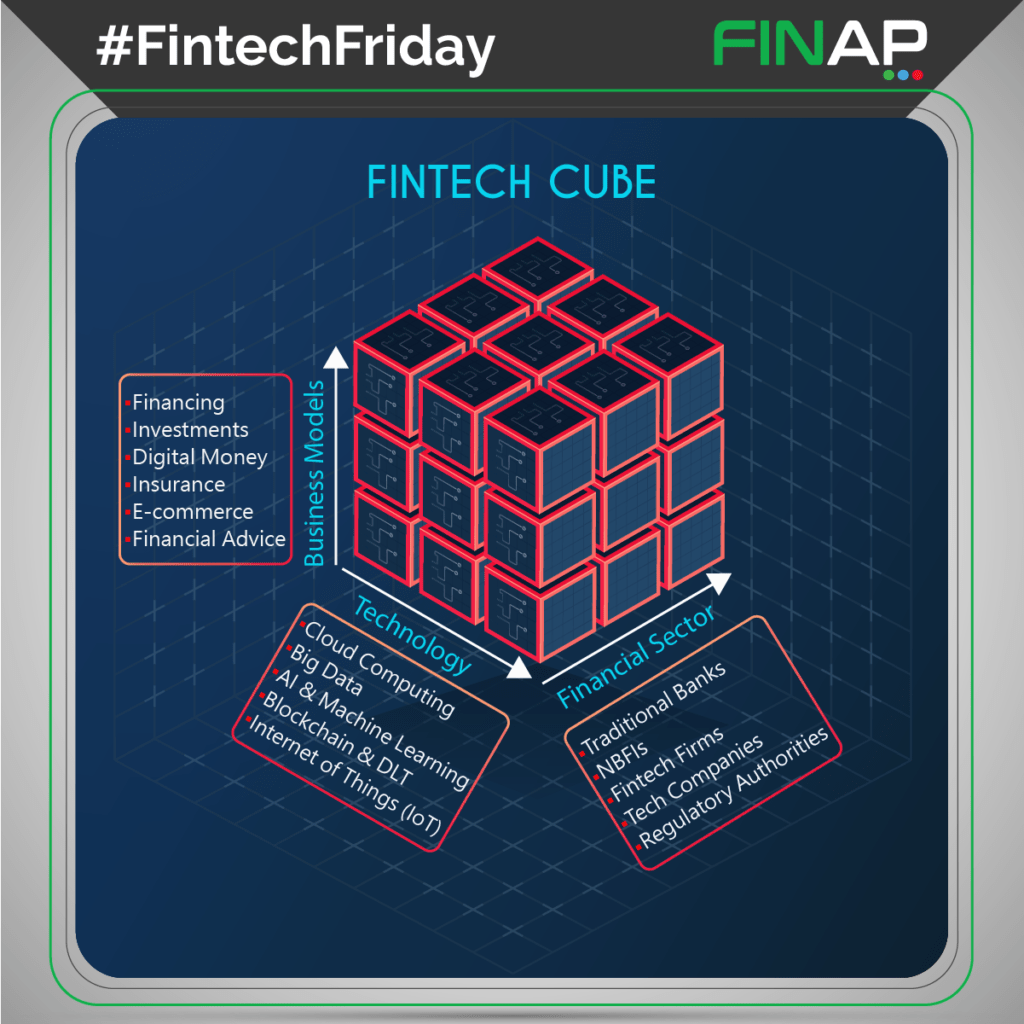

Fintech Friday Post 15 – Fintech Cube

The ‘Fintech Cube’ portrays three dimensions of digital finance. The digitalization process of the financial sector has shifted from merely improving traditional services to creating new innovative business models. The earlier infrastructure and technology of the financial industry were built to last, but the modern infrastructure must be built to change. Adaptability is the key in the modern fintech arena. While technologies such as cloud computing and big data have already made a big impact in the financial sector, innovations such as IoT and Distributed Ledger Technology (DLT) will shape the future of the industry. Moreover, the financial domain is no longer being dominated by banks alone. Fintech firms and big tech companies are also providing financial services. Digital innovations have made financial services cheaper and more customer-centric than ever.

#FintechFriday #Fintech #FINAP

Fintech Friday Post 16 – M-Pesa

Why aren’t banks investing more in technological innovations? The hierarchical structure of most banks often restricts changes and appears to be determined to uphold the status quo. Truthfully, the banking industry is refusing to invest in technologies that would make the consumer experience better. Banks need a long-term sustainable approach to change their ways and embrace new technologies to create a competitive edge. Banking should be a pleasure & not a hassle.

#FintechFriday #Fintech #FINAP

Fintech Friday Post 17 – Jim Marous - (Online Banking)

In an increasingly digitalized economy, digitalization of banking is indeed the way forward. As of 2022, nearly every bank offers their services online. So what is the problem? Offering a miniaturized version of limited functionality just for the sake of digitalization will not suffice anymore. Fintech alternatives are flooding the financial services industry every year, offering better and more convenient digital services threatening the dominance of banks.

#FintechFriday #Fintech #FINAP

Fintech Friday Post 18 Banking Innovation

Why aren’t banks investing more in technological innovations? The hierarchical structure of most banks often restricts changes and appears to be determined to uphold the status quo. Truthfully, the banking industry is refusing to invest in technologies that would make the consumer experience better. Banks need a long-term sustainable approach to change their ways and embrace new technologies to create a competitive edge. Banking should be a pleasure & not a hassle.

#FintechFriday #Fintech #FINAP

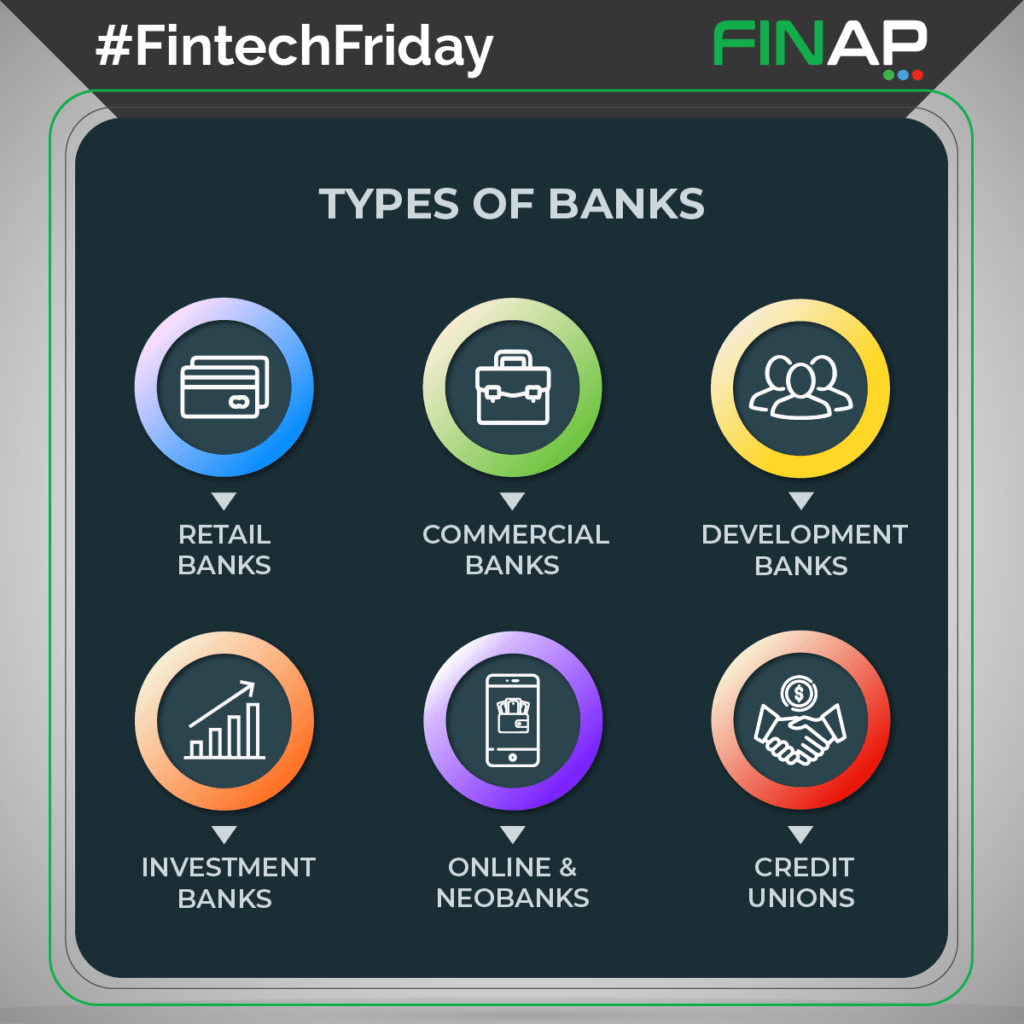

Fintech Friday Post 19 Types of Banks

In the modern financial landscape, there are many types of banks catering to various markets. Commercial & investment banks offer services for businesses, governments, and high net worth individuals. Retail banks offer consumer banking services to the general public. Development banks provide risk capital for economic development projects while credit unions aid the financially under-served. Neobanks provide customer-centric banking services via digital channels.

#FintechFriday #Fintech #FINAP

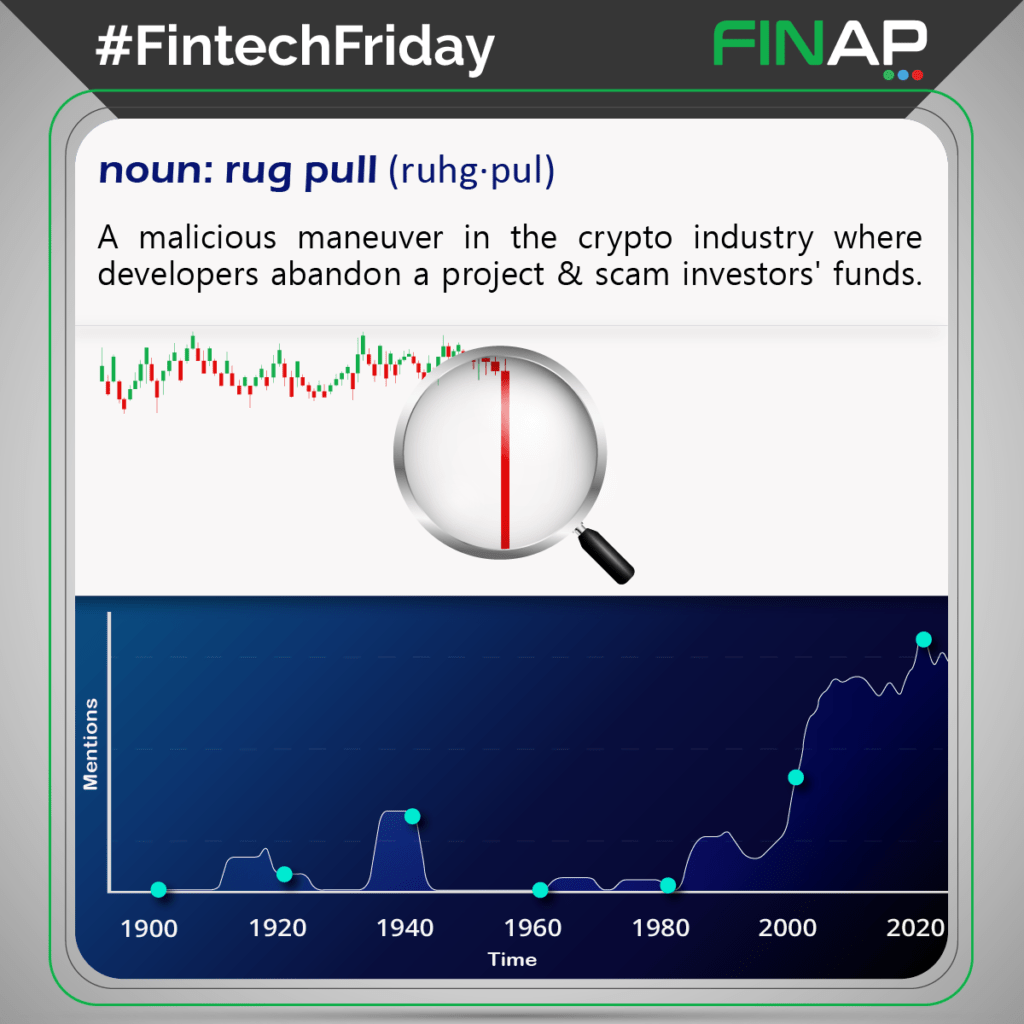

Fintech Friday Post 20 Word Definitions - Rug Pull

Word Definitions – Rug Pull – FINAP Fintech Friday

#RugPull scammers usually create cryptographic tokens and list them on decentralized exchanges. The scammers will start promoting the project by creating great hype on digital media. They will create content such as websites, videos, social media posts, blogs, and whitepapers to make the project seem legitimate. Some might even enlist celebrities and influencers to promote the token. Once the token is launched, new investors will drive the price up due to the high demand. When the price has reached a certain level, the scammers will liquidate all of their holdings at the expense of unsuspecting investors. As a result of the high selling volumes, the price will drop significantly, leaving worthless tokens in the hands of investors. The creators will completely abandon the project and run away with a large sum of money.

Although rug pulls are frequent today in crypto markets, the first rug pulls predate cryptocurrencies and targeted stock investors. In the early 1900s, fraudsters would create worthless stock certificates for unsuspecting investors.

Many of these rug pulls target new inexperienced investors. However, even seasoned investors can fall victim to rug pulls. Due to the success of some early cryptocurrencies, many investors are in fear of missing out (#FOMO) the “next big thing.” Some companies audit and rate new tokens according to the potential risk. Investors must always do their due diligence before committing because every investment carries risk.

#FintechFriday #Fintech

#FINAP

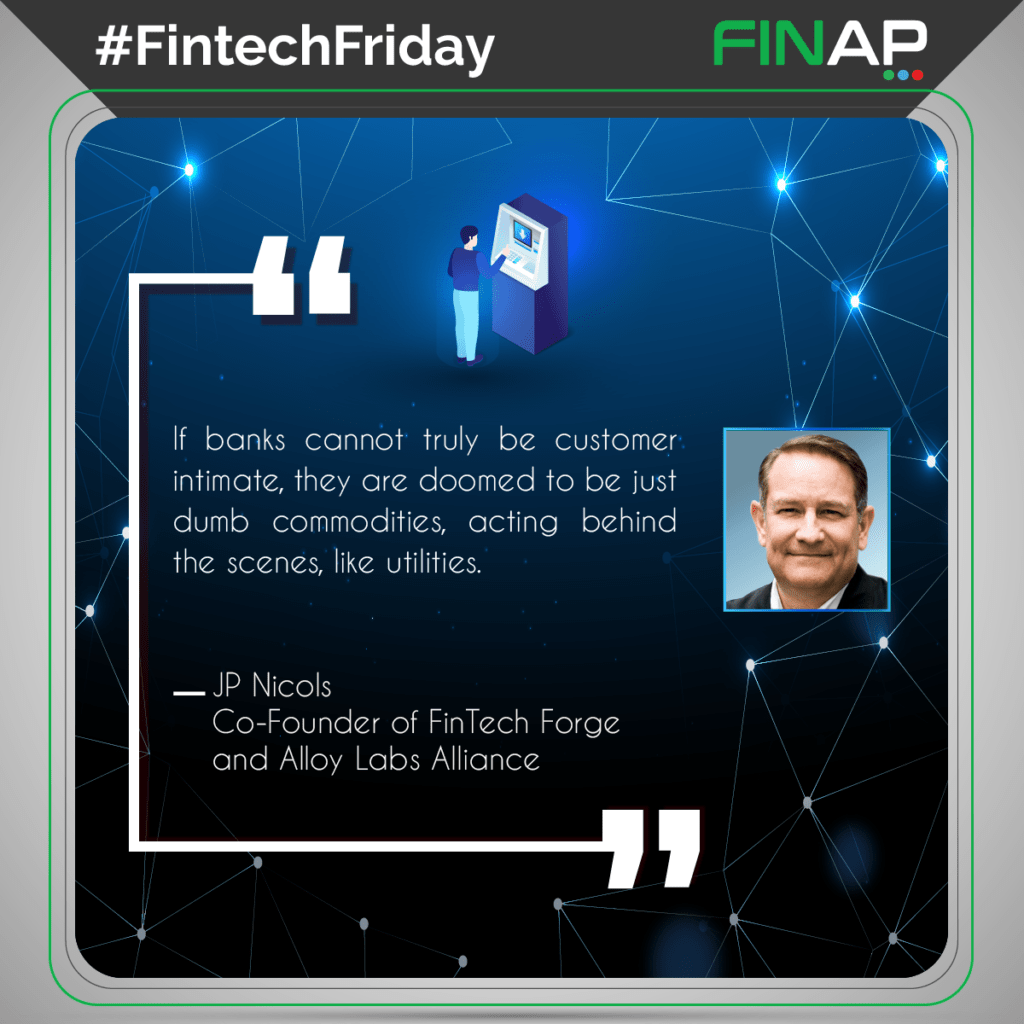

Fintech Friday Post 21 - JP Nicols (Banks' Customer Intimacy) Quote

Banks held an undisputed dominance in the financial services industry. But now, banks are looking down at serious threats arising from fintechs, neo banks, and tech giants. Slow response to changes in consumer preferences and reluctance to adopt new technologies put banks at a serious disadvantage. Many non-financial players now offer convenient, digitalized customer-centric financial services. There is a possibility that traditional banks may end up being obsolete.

#FintechFriday #Fintech #FINAP

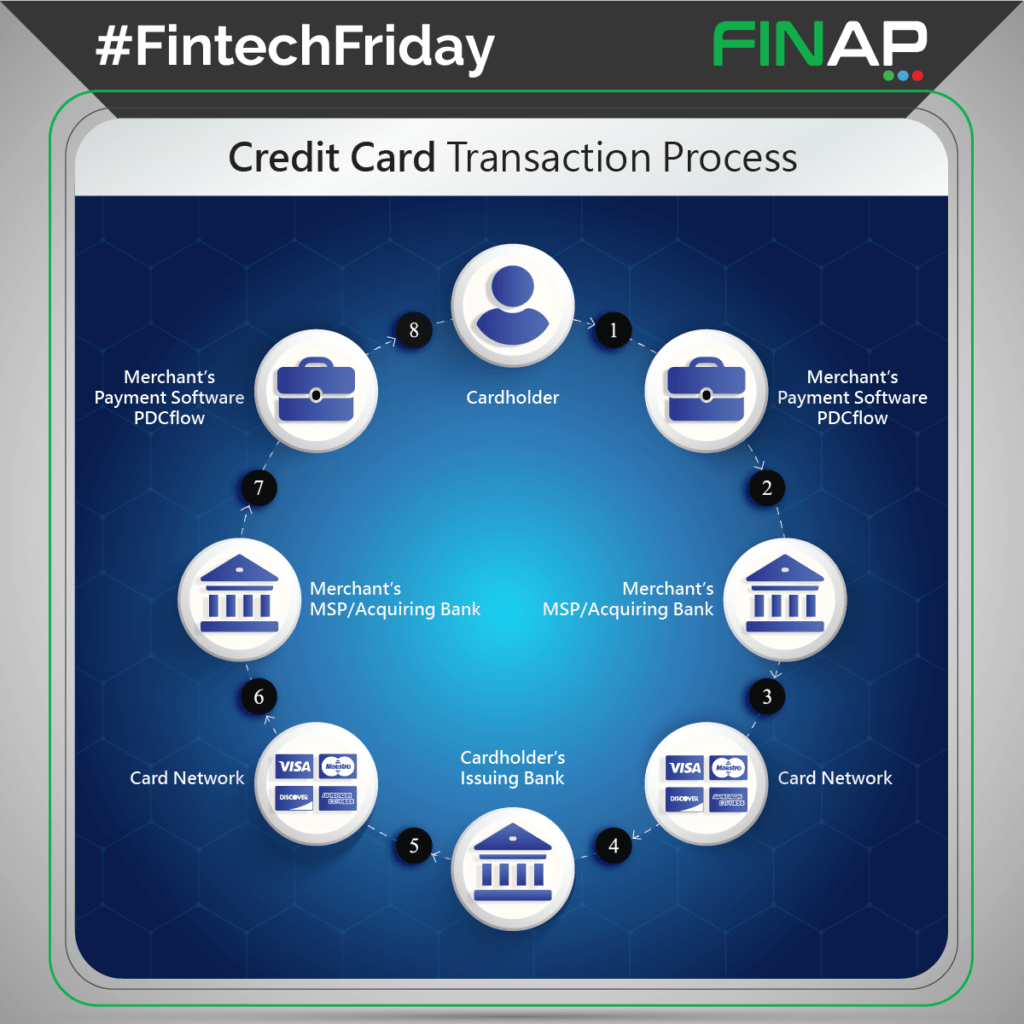

Fintech Friday Post 22 - Credit Card Transaction Process

Credit Card Transaction Process – FINAP Fintech Friday

A simple credit card transaction consumes a lot of energy, processing power, dedicated hardware, and middleware with 5 parties being involved.

Process:

1 – The cardholder makes a payment to the merchant with a credit card.

2 – The merchant’s payment software (PDCflow) sends the credit card details to MSP/acquiring bank.

3 – The acquiring bank forwards the credit card details to the credit card network.

4 – The credit card network requests payment authorization from the cardholder’s issuing bank.

5 – The issuing bank verifies the card information and send back a response to the card network.

6 – The card network sends an approval code back to the MSP or acquiring bank.

7 – The MSP/acquiring bank sends the approval code to the merchant’s payment software.

8 – The cardholder’s payment is made and the merchant’s payment software sends a receipt to the cardholder.

#FintechFriday #Fintech #FINAP

Fintech Friday Post 23 - Cloud Banking Iceberg

The cloud computing approach and the on-premises approach both seem to incur similar implementation costs on the surface. However, the hidden costs of running on-premises data centers are often overlooked, especially by financial institutions. A cloud-based approach also offers greater security, scalability, availability (99.999% is the industry standard), and agility. Cloud-based solutions can free you from the hassle of managing on-site data centers enabling more focus on your core business.

#FintechFriday #Fintech #FINAP

Fintech Friday Post 24 – Outdated KYC & Onboarding Approach

The traditional KYC approach is tedious for the consumer, and it is inefficient, labor-intensive, and too expensive from a bank’s perspective. Although KYC is crucial for banks, it must not add friction to the customer onboarding process.

Some companies are developing inter-bank eKYC platforms powered by distributed ledger technology based on the digital identity of consumers, which enables a hassle-free onboarding process for both the consumer and the bank. eKYC processes would replace the traditional document-based verification methods that drive customers away.

#FintechFriday #Fintech #FINAP

Fintech Friday Post 25 - Brett King (Banking without banks) Quote

Fintech enthusiast Brett King made this prediction a few years ago, which was a bold statement at the time. However, in 2022, two years into the pandemic, by taking into account the rapid growth of embedded technologies, blockchain, and the changing customer needs, we can see the world of finance taking shape as he envisioned. By the end of the 20s, banks will play a diminished role in facilitating day-to-day banking services if they fail to evolve.

#FintechFriday #Fintech #FINAP

Fintech Friday Post 26 – Electronic Fund Transfer (Fact)

The first Electronic Fund Transfer (EFT) was completed in the United States back in 1871; by utilizing existing telegraph networks. #EFTs were a breakthrough in financial technology because long-distance transactions could now be conducted without a physical presence. EFTs have come a long way since the 1870s. In 2020 alone, the value of digital transactions amounted to $5204 billion.

Developments in fintech have enabled even a 5-year-old can make financial transactions electronically with the help of a smart device. What will the future hold for EFTs?

#FintechFriday #Fintech #FINAP

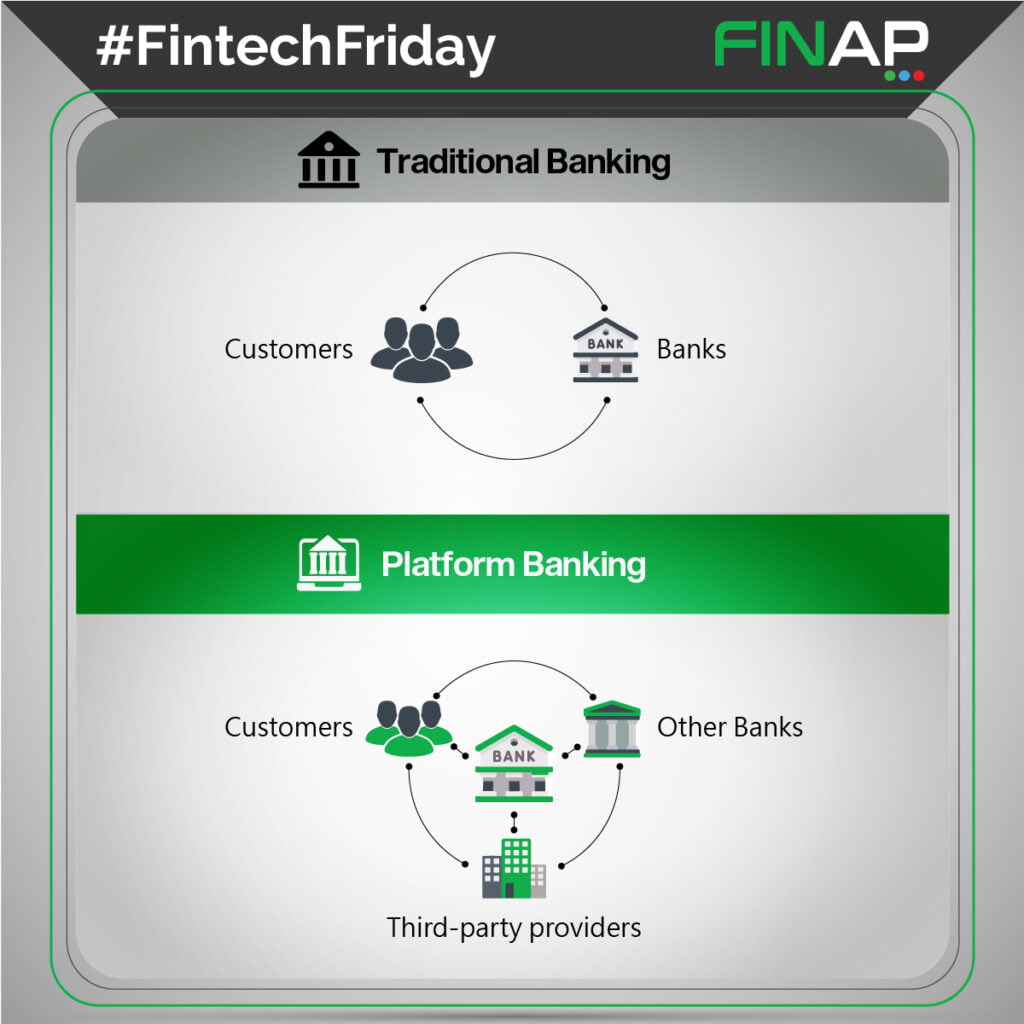

Fintech Friday Post 27 - Platform Banking

Platform banking also referred to as “Banking as a Platform (BaaP)” is a model through which fintech companies provide services to banks and other financial institutions. In the BaaP model, fintech companies develop software platforms and APIs that banks use to offer their financial services to the end consumer.

BaaP solutions enable banks to offer innovative products and services, decreasing development time and costs while enriching the customer experience.

#FintechFriday #Fintech #FINAP

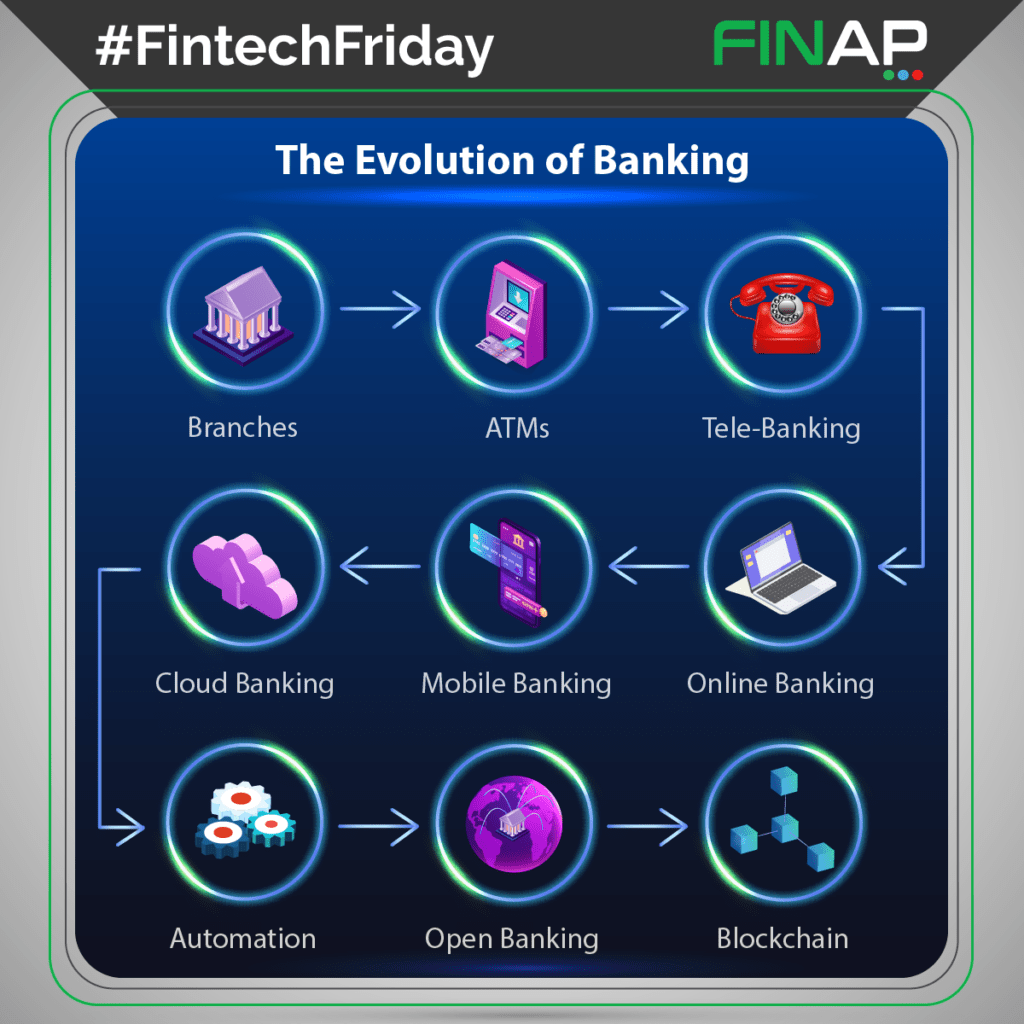

Fintech Friday Post 28 – The Evolution of Banking

For centuries, banking was centered around physical branches and did not change much in the eyes of the consumer. Today, the way consumers experience day-to-day banking services has changed immensely, thanks to fintech innovations. New technologies have opened up new banking channels. Looking at the recent developments, we can confidently say that the bank of the future will be highly automated, cloud-based, and heavily dependent on blockchain technology. Banks that refuse to evolve shall be left behind by the consumers.

#FintechFriday #Fintech #FINAP

FF 29 – Bill Gates Automation Quote

Most banks focus only on the technological aspects of automation instead of focusing on improving internal processes. Many financial service providers have inefficient, outdated processes riddled with counter-productive repeat work. These ill-fated, ill-advised automation attempts will simply magnify the inefficiencies driving customers away.

#FintechFriday #Fintech #FINAP

FF #30 – Financial Inclusion

According to the latest World Bank data, over one-third of the world’s adult population remains unbanked, and that is one of the most pressing issues of this decade. The silver lining, however, is that fintech accelerates financial inclusion on a global scale. Fintech has already enabled access to financial services for more than 1.2 billion of the previously unbanked population.

#FintechFriday #Fintech #FINAP

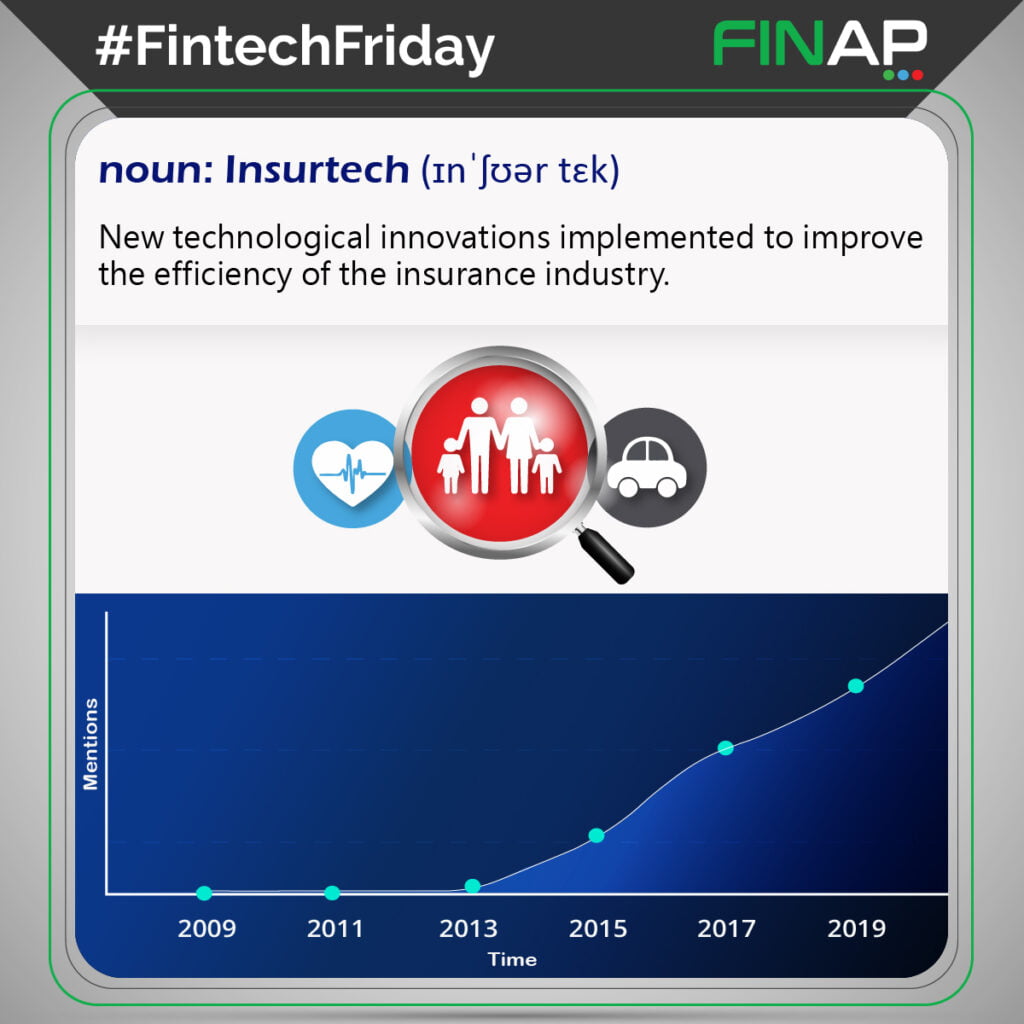

FF #31 – Word Definitions - Insurtech

Insurtech is a sub

Bset of technology that falls under the umbrella of fintech.

After 2010 new fintech startups began to emerge, providing advanced software solutions for the insurance sector.

The shortcomings of the current methods of risk assessment in the industry often result in some clients incurring more costs than necessary. The aging legacy systems are unable to cope with the vast amount of data processing required.

Insurtech solutions providers seek to solve most of the industry’s issues using AI (Artificial Intelligence), Machine learning, blockchain, and Big data.

The chart depicts the frequency of the term’s appearance in literature.

#FintechFriday #Fintech #FINAP

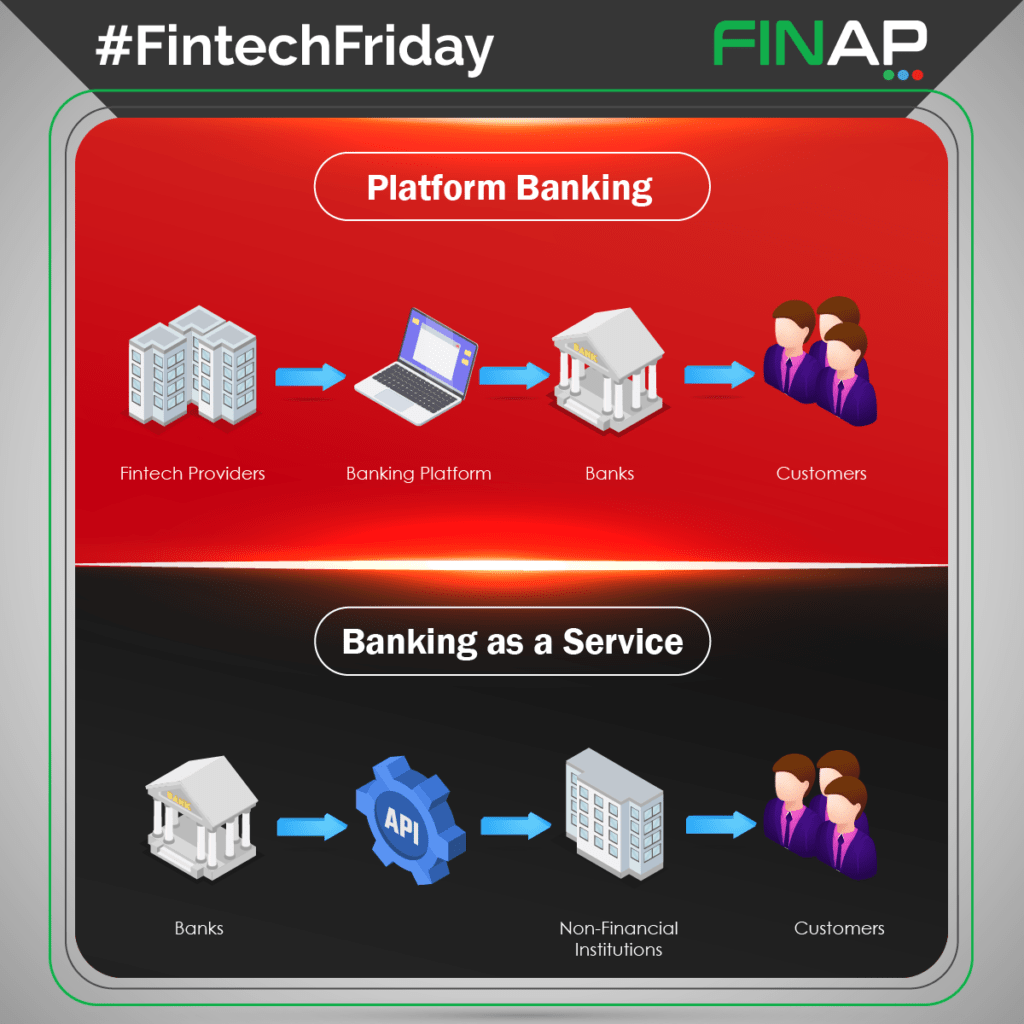

Fintech Friday Post #32 – Platform banking (BaaP) vs Banking as a Service (BaaS)

The terms platform banking (Banking as a Platform or BaaP) and BaaS (Banking as a Service) are being used interchangeably, which is incorrect. #BaaS is in fact the opposite of #BaaP.

In the BaaS model, banks become the backend, and non-banking institutions will act as the front-end serving their customers with white-labeled banking products. In the BaaP model, fintech companies develop software platforms that enable banks to provide financial services to their customers.

#FintechFriday #Fintech #FINAP

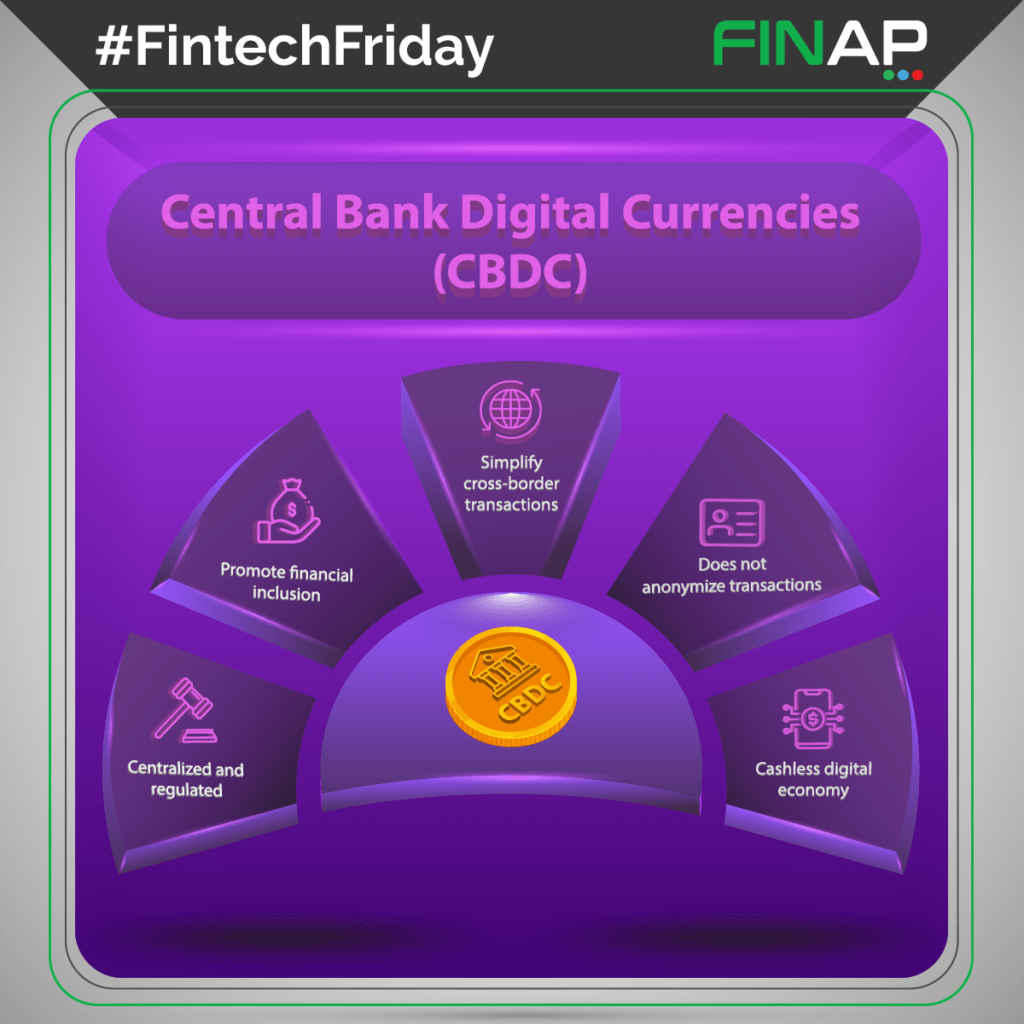

Fintech Friday Post #34 Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) are cryptographic tokens similar to cryptocurrencies. Unlike cryptocurrencies, CBDCs are centralized and issued by a Central Bank, and pegged to the nation’s official currency. CBDCs fulfill the need for a stable, widely accepted, and regulated digital currency, unlike cryptocurrencies. Some experts believe that CBDCs will pave the way for a cashless society. Central Banks are still exploring the possibilities of CBDCs.

#FintechFriday #Fintech #FINAP

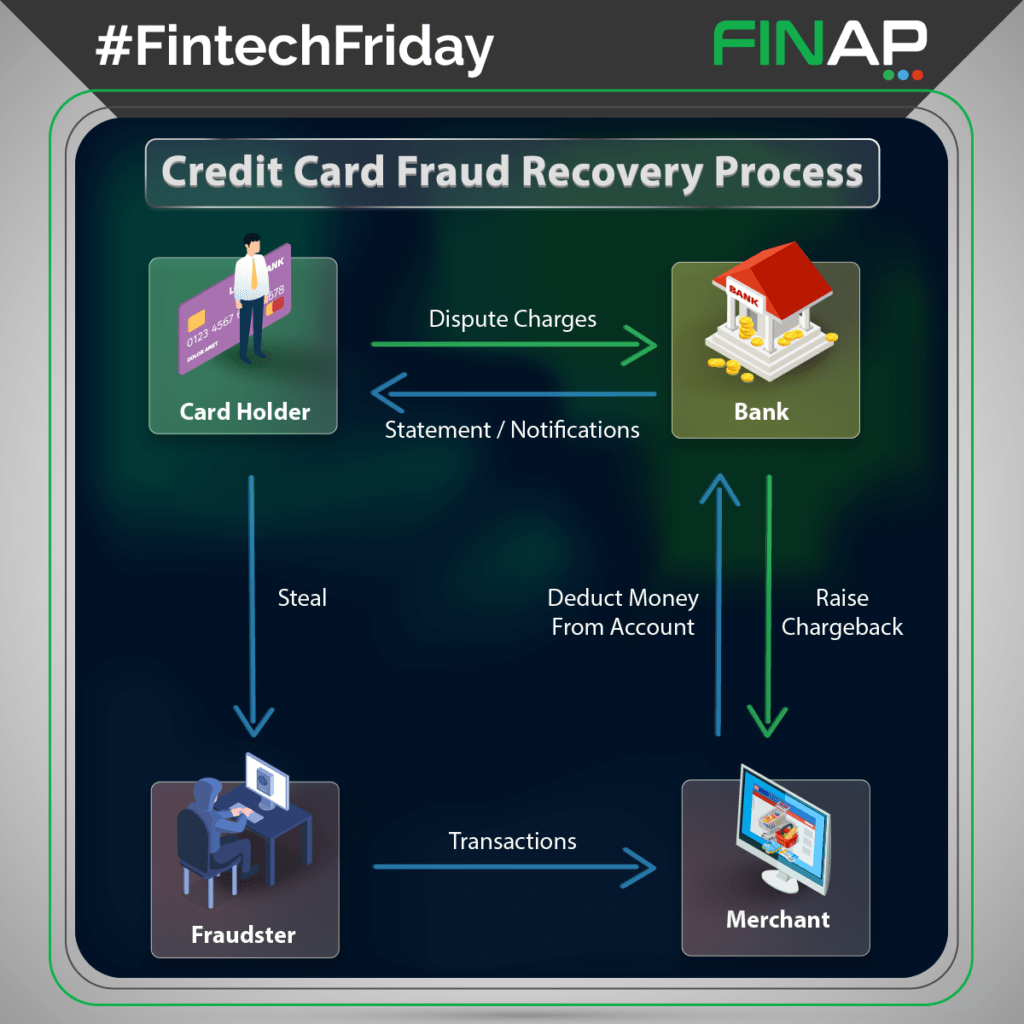

Fintech Friday Post #35 Credit Card Fraud Recovery Process

The credit card fraud recovery process (#chargeback) begins as the customer notices unauthorized credit card activity and informs the #bank. In some instances, the bank’s systems can recognize unusual activities of the card holder’s account.

Once instructed by the customer, the bank would post a temporary credit of the respective amount to the card holder’s account. The bank would contact the customer for further information and any supporting evidence or documentation, such as the #police record for a stolen credit card.

Once the investigation is done, the bank will contact the merchant and raise a dispute. The cardholder’s bank will charge the merchant the disputed amount and a chargeback fee. Then the customer’s account will be permanently credited.

If the amount of the dispute is lower than the cost of the investigation, the customer will be fully funded, and the amount is written off as a cost to the bank.

#FintechFriday #Fintech #FINAP

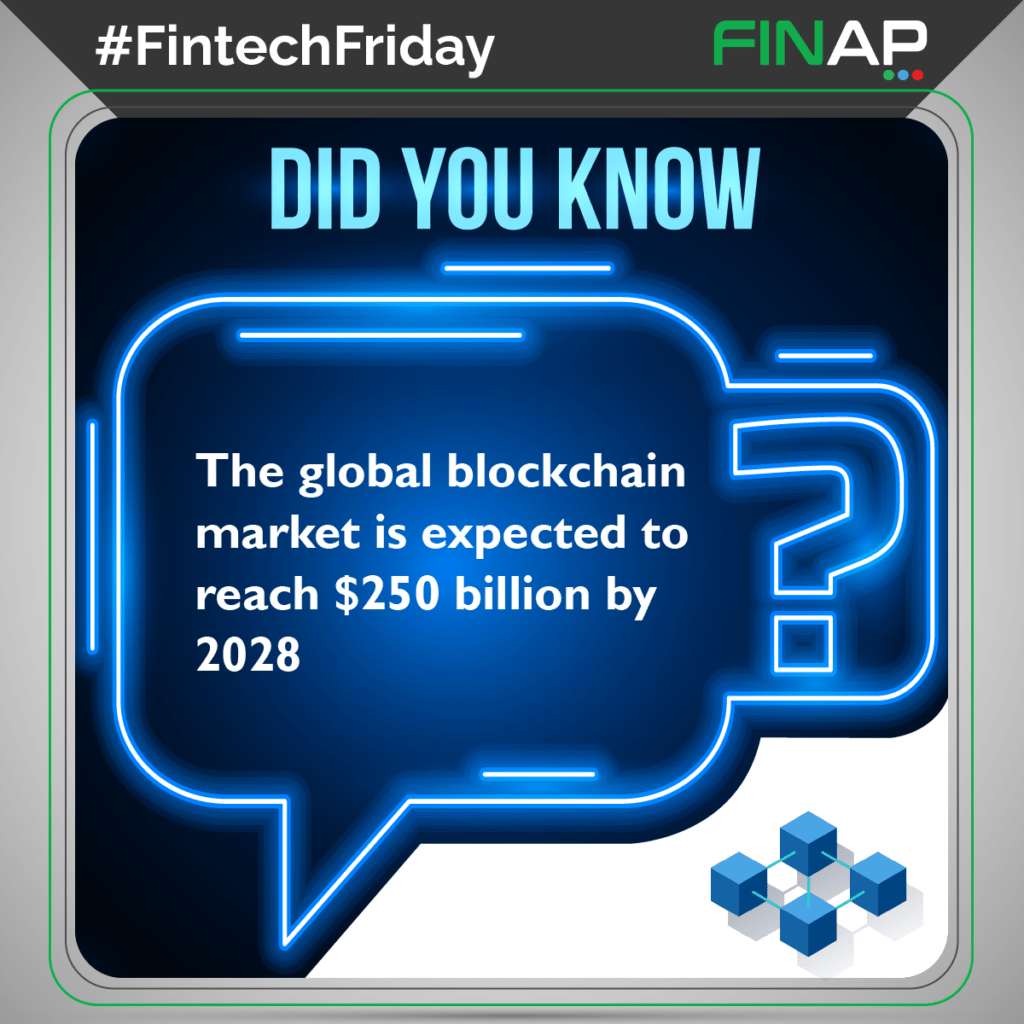

Fintech Friday Post #36 Global Blockchain Market

Blockchain industry – FINAP Fintech Friday

#Blockchain technology has come a long way since 2008. Many industries are being disrupted and revolutionized in their entirety by blockchain #ecosystems. The immutability and the decentralized nature of blockchains are ideal for many industries. The blockchain industry has already become a billion-dollar industry, and rapid growth is expected in years to come.

#FintechFriday #Fintech #FINAP

Fintech Friday Post #37 – Jo Ann Barefoot - Quote

#Millennials are used to living in a world where everything is instantaneous. They expect financial services to be no exception. By holding on to the traditional banking channels, banks are ignoring and alienating an entire generation of future customers. Millennials will not wait in line but look for alternatives.

#FintechFriday #Fintech #FINAP

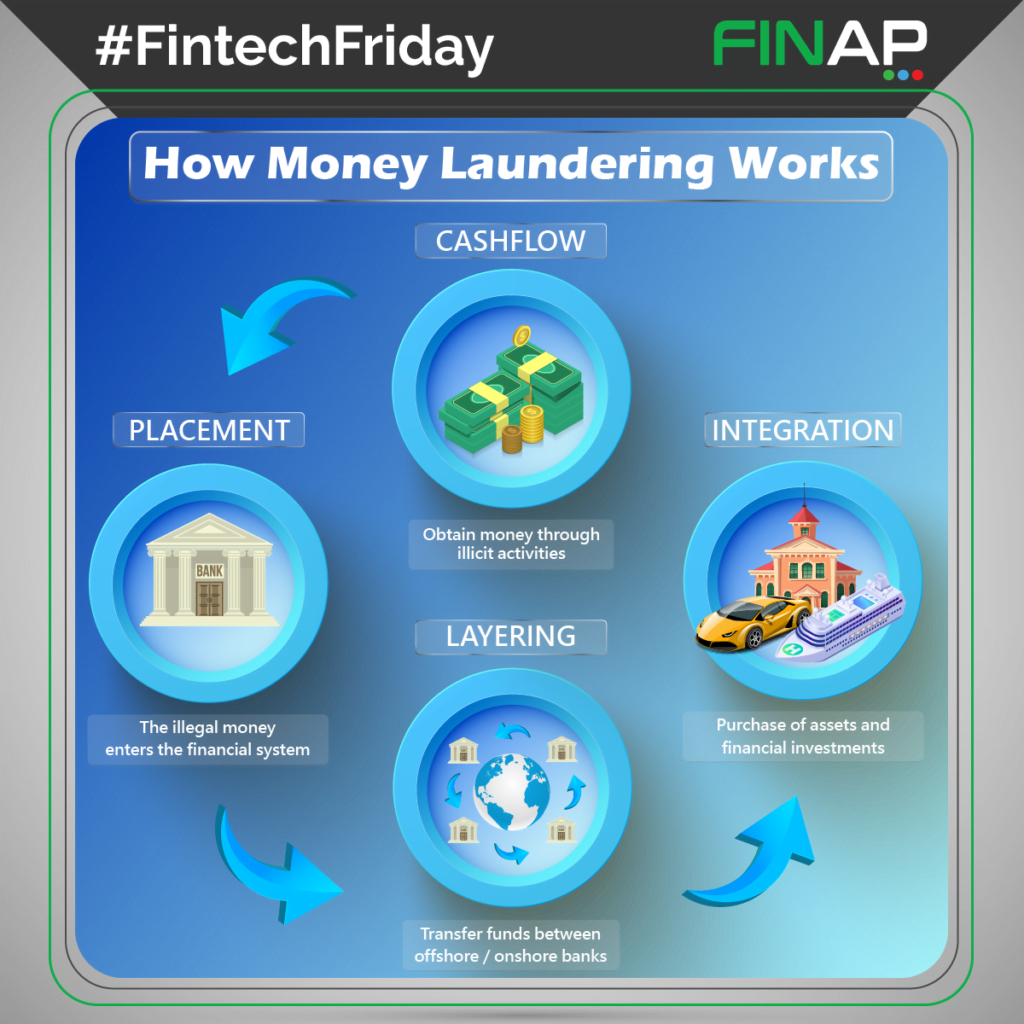

Fintech Friday Post #38 – Money Laundering Process

Money Laundering Process Infographic

Money laundering is the process of making money generated by illicit activities such as misuse of public funds, corruption, terrorist activities, and drug trafficking appear legitimate. How is money laundering done?

1. Placement

The money laundering process begins as the “dirty” money enters the financial system. To avoid detection, the funds may be deposited in smaller sums or deposited to offshore accounts. This is the stage where the money-laundering scheme is most vulnerable. Banks with sophisticated software systems can monitor and identify suspicious activities.

2. Layering

Layering is the separation of the funds from their unlawful origins. Complex layers of deposits, withdrawals, investments, and purchases can conceal the proceeds from their true origins.

3. Integration

Once the layering is done, the true origin of the money is hard to detect. Now it’s time for the “clean money” to reunite with its original owner.

Hundreds of billion dollars are being laundered globally every year. Banks employ #KYC (Know-Your-Customer) and #AML (Anti-Money Laundering) procedures to combat money laundering. Failure to do so may result in lawsuits, fines, and reputational damages for financial institutions. Therefore, a proper platform for KYC and AML is vital for all types of financial institutions.

#FintechFriday #Fintech #FINAP

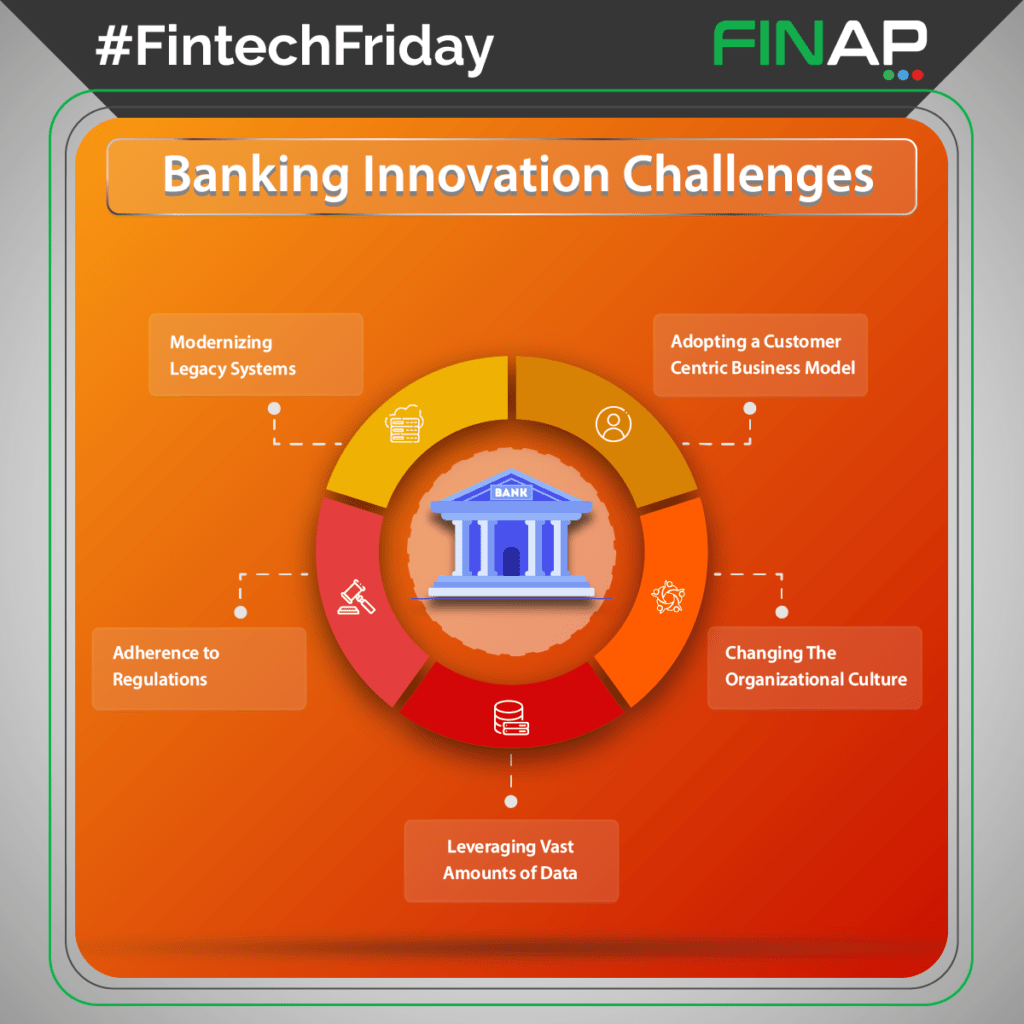

Fintech Friday Post #39 – Banking Innovation Challenges

The words banking and innovation are rarely mentioned in the same sentence. However, there once was a time when banks were pioneers of technological innovation. Banks were one of the earliest industries to adopt the use of computers and automation. Today banks are not keeping up with new technologies. Unlike other industries, banks encounter many challenges to innovate. Banks will have to overcome these hurdles or risk being ending up in the backwaters of the finance industry as “dumb utilities”.

#FintechFriday #Fintech #FINAP

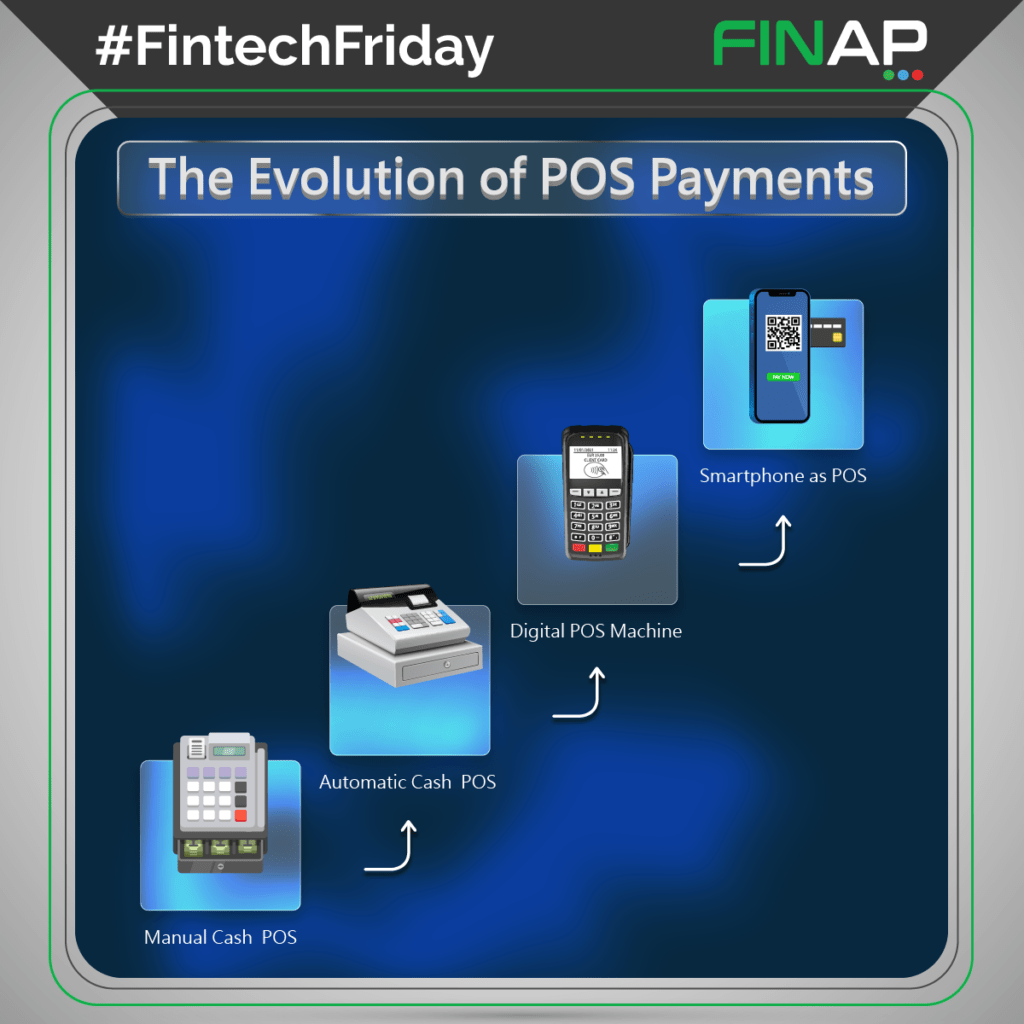

Fintech Friday #40 – Evolution of POS Payments

Point of Sales (#POS) payments have evolved significantly from simple cash registers to smartphone-powered (#mPOS) smart terminals. In the 1980s, the use of credit cards became mainstream, and with it, POS terminals became commonplace. In the 2000s POS machines became smarter and more powerful. Cloud-based #ePOS terminals and Near Field Communication (#NFC) POS terminals replaced the older simpler machines. Today smart devices are being used as complex multipurpose POS terminals. The future of POS payments will depend on smart devices.

#FintechFriday #Fintech #FINAP

Fintech Friday Post #41 – Automation Quote

Process automation can improve the banking industry by enhancing quality, and efficiency and reducing costs. A large proportion of the workforce in the industry is working on mundane tasks. Automation of these mundane processes will free up more resources, which could be allocated more efficiently.

#FintechFriday #Fintech #FINAP

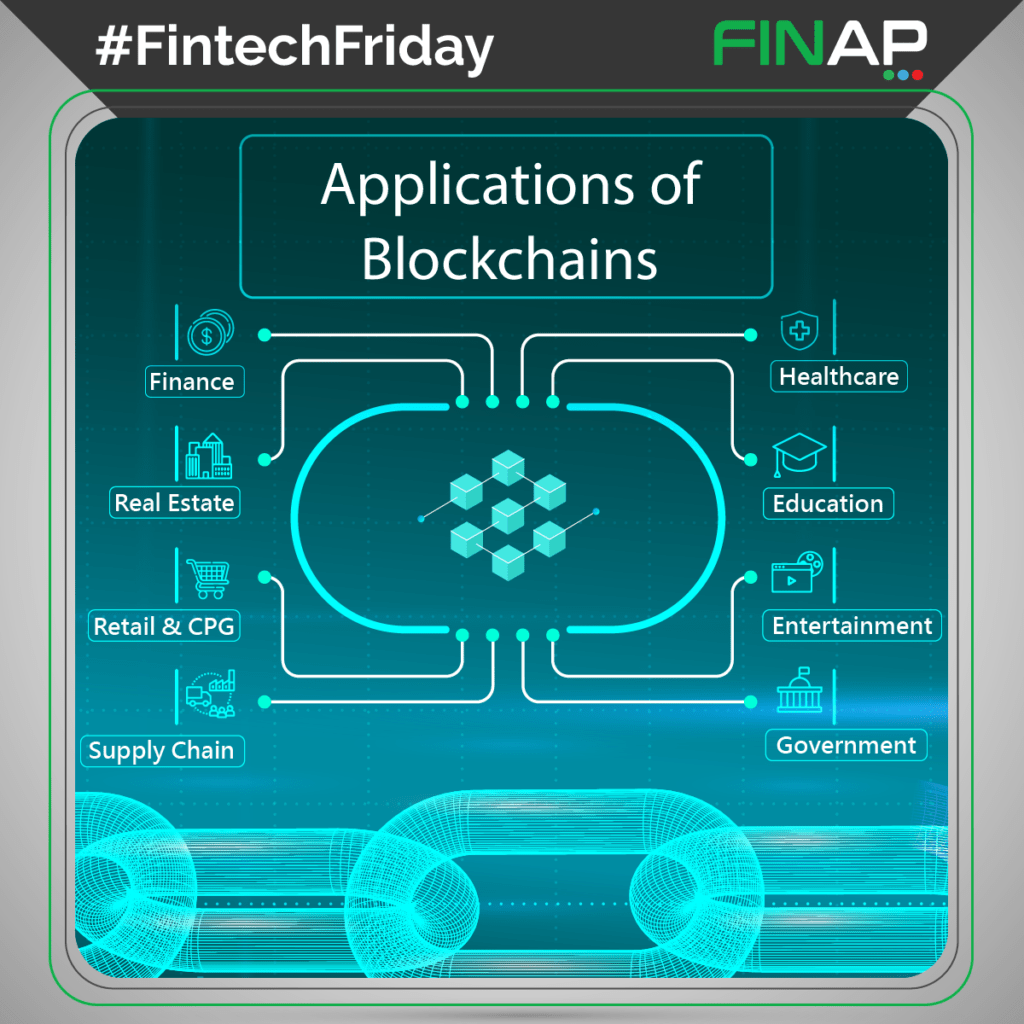

Fintech Friday Post #42 – Applications of blockchain

Blockchain has become the new buzzword in many industries. In a few years, blockchain will be a mainstream technology. Most people still associate blockchains with cryptocurrencies and NFTs. But in reality, the scope of blockchain transcends far beyond digital assets. We are heading towards a blockchain-powered future.

#FintechFriday #Fintech #FINAP

Fintech Friday Post #43 – DeFi (Decentralized Finance)

DeFi (Decentralized Finance) is a fully functioning financial system that can operate on its own without intermediaries or a centralized authority.

A DeFi system runs on a network of decentralized devices powered by blockchain technology. The DeFi space consists of many decentralized applications (dApps) using smart contracts that offer financial services such as lending, borrowing, and saving. The use of blockchains and smart contracts eliminates the need for a middleman (intermediary) or regulatory authority.

Most futurists predict that DeFi could be the future of the finance industry.

#FintechFriday #Fintech #FINAP

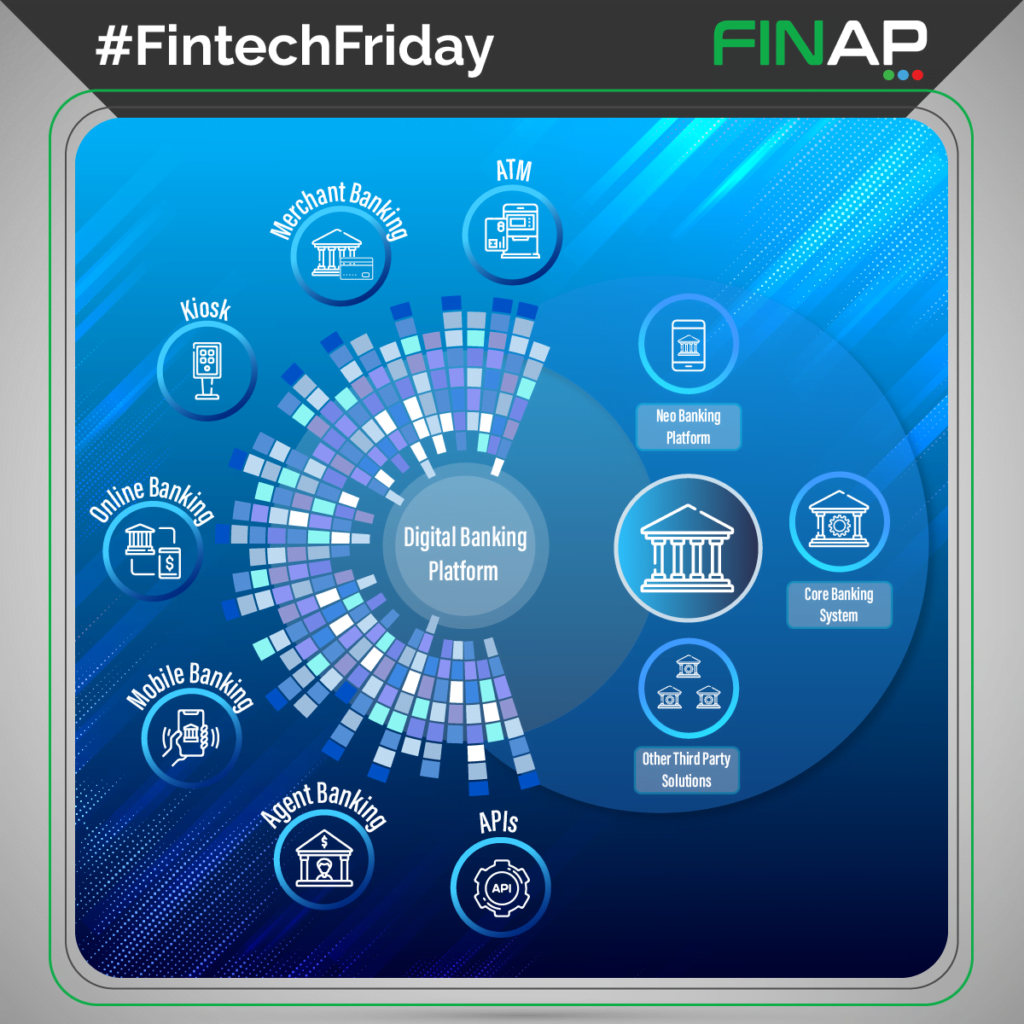

Fintech Friday Post #44 – Digital Banking Platforms

Digital banking platforms have enabled banks to take on a more customer-centric approach. Platform banking enables banks to offer new innovative solutions, staying competitive with tech companies. Unlike old legacy systems, digital banking platforms offers consumers an Omni-channel banking experience.

#FintechFriday #Fintech #FINAP

Fintech Friday Post #45 – Arvind Sankaran Quote

We’re witnessing the creative destruction of financial services, rearranging itself around the consumer. Who does this in the most relevant, exciting way using data and digital, wins!

Arvind Sankaran Banking Quote

For the first time in history, banks have competitors in the form of Tech companies. FinTech innovations have allowed even non-financial firms to offer distinguished financial services to customers, giving them a competitive edge in the market.

With the already increasing operational costs of traditional banking channels, not even some of the biggest banks are in a position to facilitate the convenience offered by FinTech/Tech firms. The banks that actually understand this have shifted their focus to innovation and automation, and consequently to better customer service and market share.

#FintechFriday #Fintech #FINAP

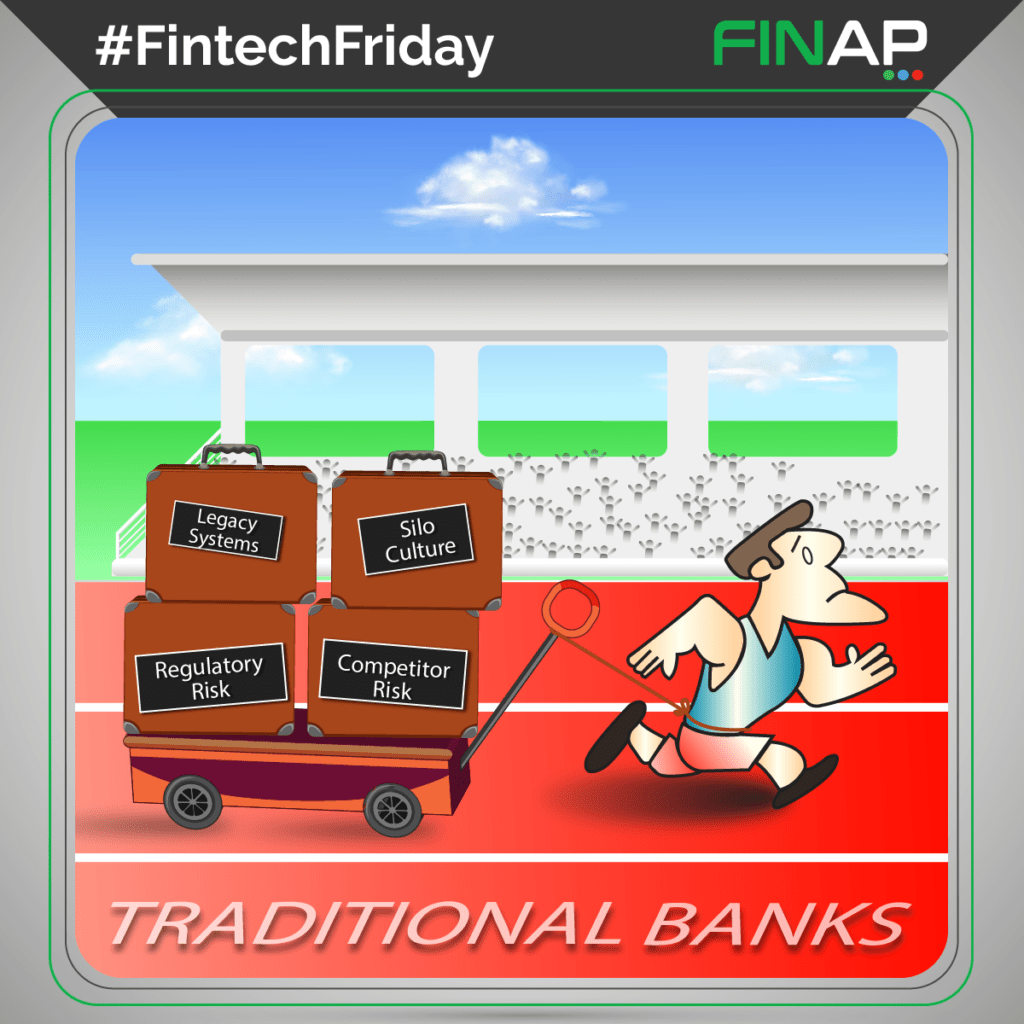

Fintech Friday Post #46 – Banking Baggage

It looks like some traditional banks are competing with a lot of constraints. Legacy systems, silo culture, and the brick & mortar setup are slowing down innovation, restraining them from providing an agile service. In the 2020s, agility is the key. Most traditional banks cannot compete with Neo banks and Fintechs in terms of agility.

In order to get ahead, banks will have to lose some of the “baggage”. Adopting new technologies and getting rid of legacy systems would be a good place to start.

#FintechFriday #Fintech #FINAP

Fintech Friday Post #47 – Smart Contracts

Smart contracts have become a buzzword in the DeFi industry. Smart contracts are self-executing contracts written into a decentralized blockchain network. The terms of a smart contract are irrevocable, which permits transactions and agreements without a legal system or a third-party mediator. Some futurists predict that smart contracts may replace the traditional legal system.

#FintechFriday #Fintech #FINAP

Fintech Friday Post #48 – dApps

Decentralized applications, which are more commonly known as dApps, are software that operates on a peer-to-peer (P2P) blockchain ecosystem. A dApp is also an open-source application allowing other developers to build on top of it. dApps are still at their inception and are harder to develop and maintain when compared to centralized apps. However, dApps might play an important role in the future of banking & finance.

#FintechFriday #Fintech #FINAP

Fintech Friday Post #49 – Nigel Morris Quote

The financial services industry is being revolutionized by disruptive technologies. Brick and mortar branches will soon become obsolete. Millennials and Gen Z accounts for a huge chunk of banking customers. They prefer financial services to be like any other service – instantaneous and hassle free.

#FintechFriday #Fintech #FINAP

Fintech Friday Post #50 Blockchain in Banking

At its inception, #blockchain technology was introduced as an alternative to the existing outdated financial infrastructure. And today, while most banks still rely on brick & mortar infrastructure, paperwork, and legacy systems, blockchain technology enables faster & cheaper payment processing, better data security, and enhanced #KYC processes. Some of the largest financial institutions in the world are now starting to adopt blockchain technology to improve their services. Perhaps #branchless and #paperless banking is not very far off!

#FintechFriday #Fintech #FINAP

Fintech Friday Post #51

Banks still require customers to visit their branches from time to time. Even though most banks have apps and web portals, they offer very limited functionalities. Unlike many other industries, the banking industry is yet to fully digitalize. The industry’s reluctance to change shall prove costly in the near future. A large portion of banking customers consists of Millennials and Gen Z, who would rather find fintech and DeFi alternatives rather than visit a branch and waste their time.

#FintechFriday #Fintech #FINAP

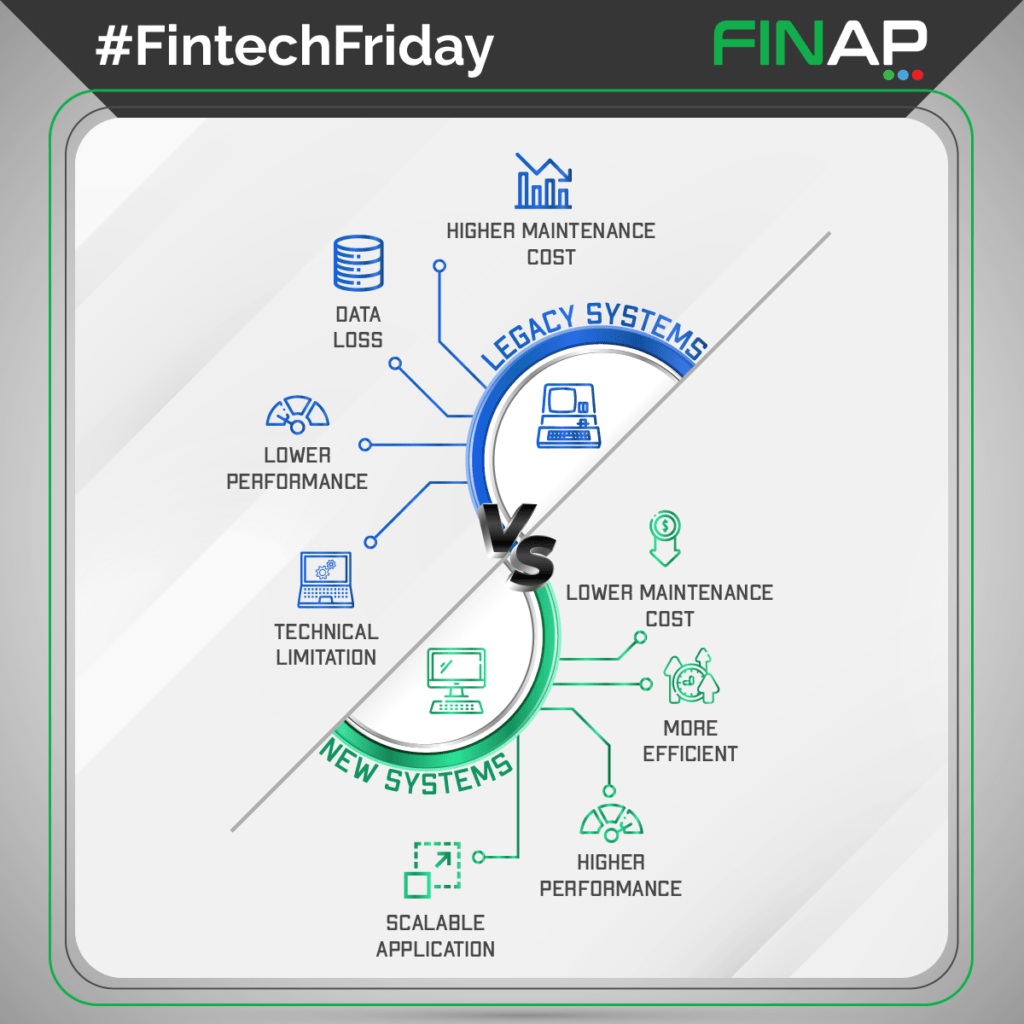

Fintech Friday Post #52 Legacy vs Modern Systems

Most banks tend to stick to their legacy systems and delay modernization for convenience and to reduce costs. In reality, legacy systems need much more maintenance, are vulnerable to security threats, are inefficient, and are low in interoperability. Most outdated systems pose serious security threats and may cost a financial institution more than money.

#FintechFriday #Fintech #FINAP

Fintech Friday Post #53 Brett King Quote

Why do we need FinTech? Because traditional banking practices are outdated. The dependency on physical locations, legacy systems, and paperwork has made the entire industry seem absurd in today’s fast-paced, technology-driven world. It’s time for a much-needed and long overdue FinTech upgrade by doing away with outdated processes and embracing new technology such as cloud computing, AI, and blockchain.

#FintechFriday #Fintech #FINAP