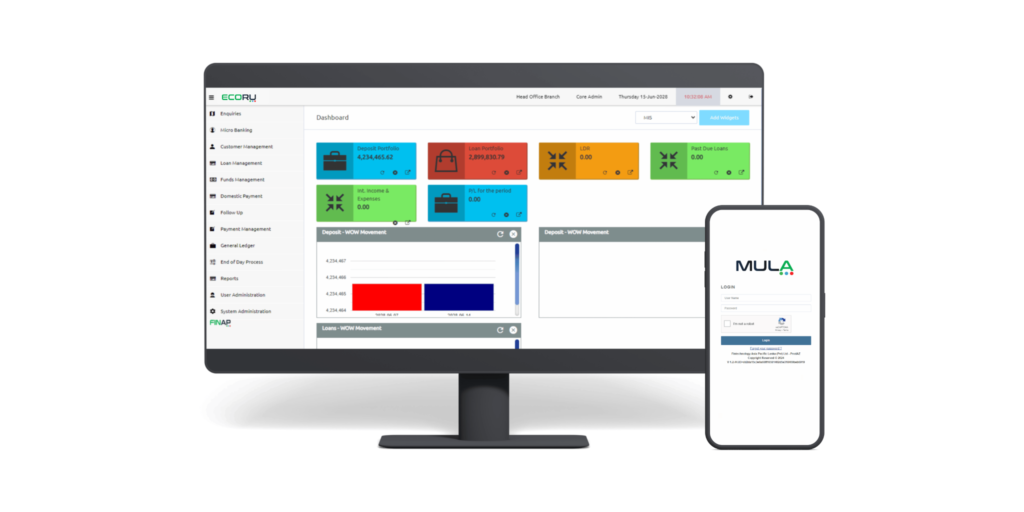

ECORU - The Banking Software

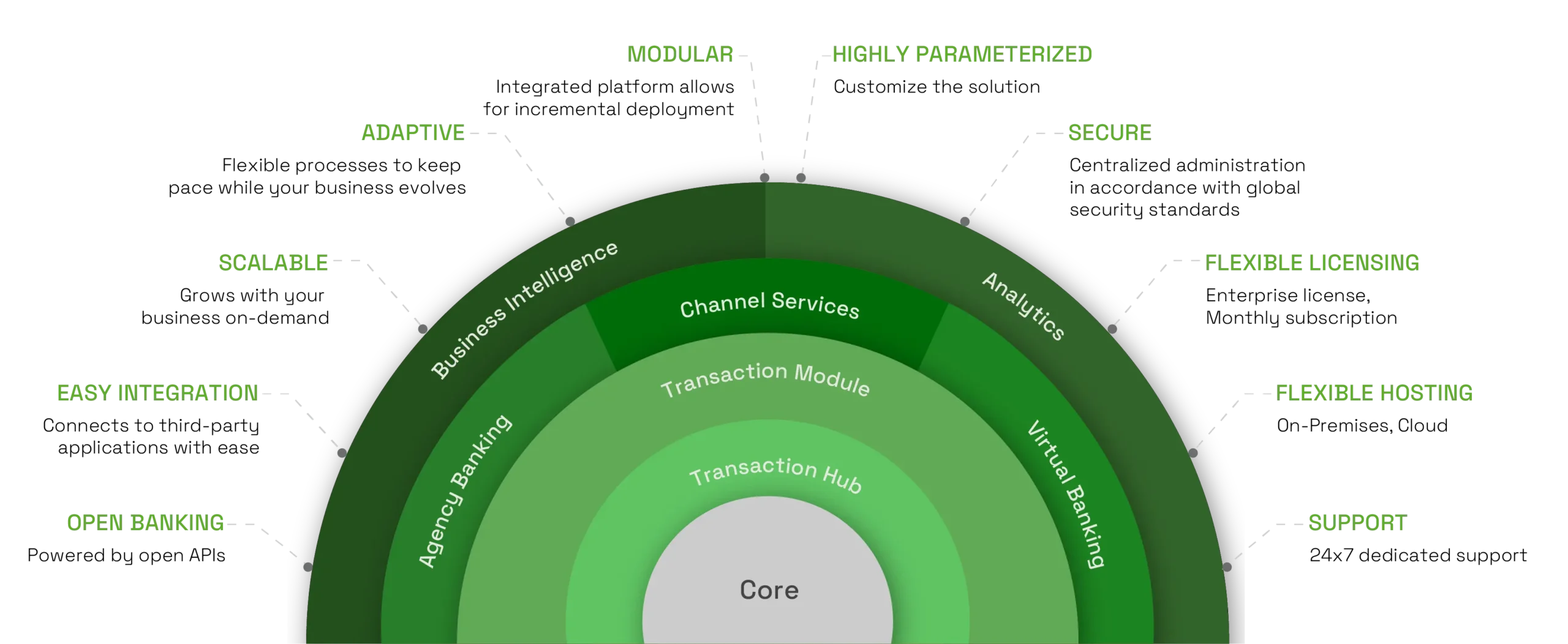

It is an all-inclusive, modern yet simple digital Core Banking Software built to empower small to more complex finance institutions & banks. Designed by industry specialists in accordance with international standards, our solution offers Financial Service Providers the opportunity to create new distribution channels, competitive products, cost-effective service delivery, and provide a better customer experience.

Our flagship fintech product designed by domain experts for a variety of business segments such as,

Story of ECORU

ECORU was born not out of theory, but out of first-hand experience inside some of the world’s most complex financial institutions.

Its origin traces back to 2016, when FINAP’s founder, Dr. Kutila Pinto — a career banker with leadership experience across global institutions and frontier markets — began questioning a fundamental flaw in financial systems:

they were designed for balance sheets, not for real operating realities.

Across developed and emerging markets alike, Dr. Pinto observed the same pattern repeated:

Systems built decades earlier, patched repeatedly but never re-engineered

Technology that served compliance, but constrained innovation

Institutions forced to adapt their business models to their systems — instead of the other way around

Nowhere was this mismatch more visible than in microfinance and inclusive banking, where institutions serving the most complex customer segments were often operating with the least capable tools.

ECORU was conceived to address that gap.

What Makes it Special?

Why Does It Stand Out?

List Of ECORU Modules

Customer Management

Manage client onboarding, capture KYC data, and provides a 360° view of customer profiles, assets, and liabilities for better management.

Loan Origination

A module that runs all stages of the lending process starting from customer data collection up until loan disbursement.

Loan Management

Loan Follow-ups

A module that runs all stages of the lending process starting from customer data collection up until loan disbursement.

Credit Line Management

Manage entire credit lines from donor agencies and also tracks bank loans and individual investments to your business.

Micro Banking

Seamlessly manage group lending, with center, group, and member creation and maintainence.

Savings Account Management

Seamlessly manage multiple savings products and maintain pass books.

Term Deposits Management

Cash Management

Domestic Payment

Cheque Payment

General Ledger

User Administration

System Administration

Book a Live Demo With Us

Partner with us for a core modernization to take your financial institution to the next level.

FINAP has delivered cutting-edge Fintech solutions for financial service providers for many years. We also pride ourselves on providing exceptional customer service 24/7/365. Be a part of our happy clientele.

Give us a call or send an email now to book a demo with us today!

Customer Support

Technical FAQ

We use robust encryption techniques, multi-factor authentication, and continuous monitoring to safeguard sensitive data. Regular security assessments and updates mitigate emerging threats effectively.

Ensuring data security through Azure Security services and adherence to OWASP principles, including input validation, authentication mechanisms, and encryption protocols.

Clean Architecture, MVC, Domain-Driven Design, and the Repository Pattern enhance development, promote modularization, and abstract data access.

We utilize Angular, Knockout.js, JavaScript, jQuery, and HTML5 for the front end, and .NET 6, REST API, OAuth 2.0, ADO.NET, and Python for back-end development.

It provides extensive customization options tailored to each institution's specific needs. Our dedicated team offers comprehensive support and expertise to ensure smooth integration with existing systems.

Business FAQ

It is an all-inclusive, modern digital Core Banking Software designed to empower finance institutions and banks. It stands out by offering new distribution channels, competitive products, cost-effective service delivery, and an enhanced customer experience.

It is designed for a variety of business segments within the banking and finance industry. It caters to small to complex finance institutions and banks, providing them with a comprehensive solution built by industry specialists in accordance with international standards.

The journey of ECORU began in 2016 when banking and microfinance domain experts aimed to address common industry issues. The primary challenge was the dependency on outdated legacy systems globally. Through extensive collaboration with industry professionals, ECORU emerged as a future-proof, cloud-based, comprehensive software solution after rigorous testing and quality assurance.

It paves the way for paperless banking by providing a modern digital Core Banking System. Its features enable efficient document management, electronic transactions, and seamless integration, reducing the reliance on paper-based processes.

We empower Financial Service Providers with cost-effective service delivery, allowing them to create new distribution channels and offer competitive products. The solution is designed to enhance the overall customer experience, providing a modern and efficient banking platform.

What is ECOru ?

FINAP Software Products

- ECOru - The Banking Software

- FirstMicro – The Microfinance Software

- Cixor - The Nanofinance Solution

- MULA - Field Agent Mobile Application

- OCEANUS – Neo Banking & Wallet Solution

- OMS – Retail Order Management & Forecasting Solution

- WMS Plus – Warehouse Management System

- LMD – Ultimate Last-Mile Delivery Solution

- FLEX - “Uber” For Logistics Solutions

- AR Tracker – Accounts Receivable