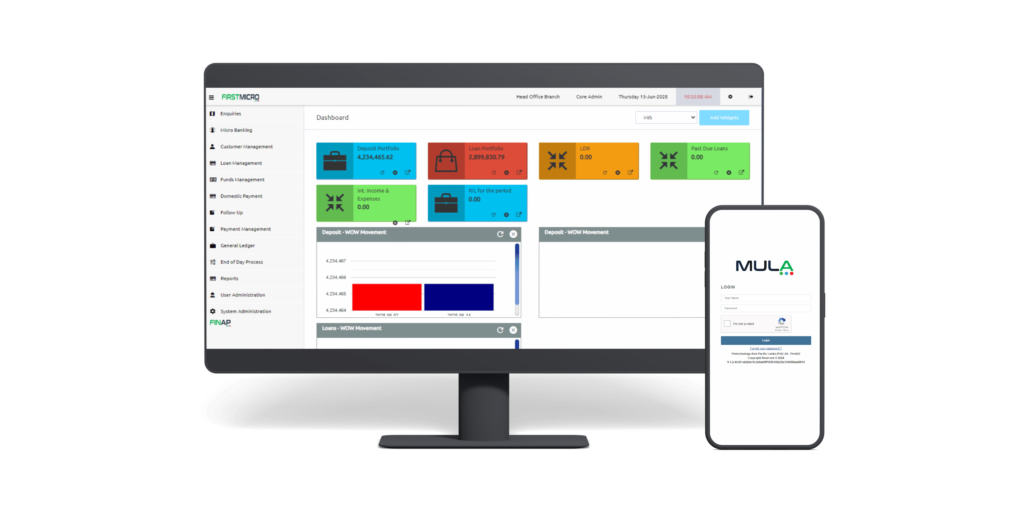

FirstMicro - The Microfinance Software

FirstMicro is a comprehensive microfinance software solution designed to streamline your operations and enhance efficiency. Whether you manage loans, monitor payments, or generate insightful reports, FirstMicro provides the tools you need to succeed.

Key Modules of FirstMicro Microfinance Solution:

- Efficient Customer Management: Easily manage customer information and track interactions to improve service and satisfaction.

- Streamlined Loan Management: Simplify the loan approval and disbursement process for faster, more accurate service.

- Group Lending: Support group lending with features designed specifically for managing group loan products.

- Reports & Enquiries: Access over 25 system-generated reports to gain insights and make informed decisions.

- Improved Loan Follow-up Processes: Enhance your loan recovery process with better follow-up and tracking tools.

- Automated Alerts & Notifications: Stay informed with automatic alerts for key events and deadlines.

- Comprehensive Payment Management: Manage payments efficiently with detailed tracking and processing.

- Field Agent Mobile App: Equip your field agents with a mobile app for on-the-go customer and loan management (Available only upon request).

- Automated General Ledger: Keep your finances in order with an automated general ledger that ensures accurate and up-to-date financial records.

FirstMicro Microfinance Solution is the quintessential toolkit for microfinance institutions, especially tailored for small and medium-sized enterprises (SMEs). It is engineered to be a pivotal resource in enhancing their operational framework and propelling them towards unprecedented levels of success.

With FirstMicro, these institutions gain a reliable and powerful suite of tools that are integral to their growth and service optimization.

Experience FirstMicro – Get Free Demo!

Experience how FirstMicro can transform your microfinance business. Call us or send us an email to get a demo and a complete list of product features.

Unlock the potential of your microfinance operations with FirstMicro – the reliable, efficient, and scalable solution for all your needs.

Contact us for more information or speak to a representative.

Customer Support

Technical FAQ

Business FAQ

What is ECOru ?

FINAP Software Products

- ECOru - The Banking Software

- FirstMicro – The Microfinance Software

- Cixor - The Nanofinance Solution

- MULA - Field Agent Mobile Application

- OCEANUS – Neo Banking & Wallet Solution

- OMS – Retail Order Management & Forecasting Solution

- WMS Plus – Warehouse Management System

- LMD – Ultimate Last-Mile Delivery Solution

- FLEX - “Uber” For Logistics Solutions

- AR Tracker – Accounts Receivable